Luxury market remains robust, showing strength and resilience heading into Fall.

The South Florida market remained very active this summer, with snowbirds reportedly flying down to the area quite frequently to view the newest listings from Miami to Palm Beach. To assess the current market status as summer ends, we consulted Jay Phillip Parker, CEO of Brokerage, Florida Region and President of Douglas Elliman Development Marketing, along with brokers Nancy Batchelor of Compass, Susan Turner and Joanne Wagner of Corcoran, Samantha Curry of Douglas Elliman, and Jennifer Kilpatrick of Corcoran.

Jay Phillip Parker of Douglas Elliman shared his positive outlook for the area: “There are numerous variables that continue to support the stability and strength of the South Florida luxury market. The more traditional attractions like weather, quality of life, and vacation-like living remain as strong as ever. These are further enhanced by the ongoing maturation of South Florida’s offerings in culture, culinary, medicine, and the ever-evolving, relentless pursuit of higher quality by our developers in their residential offerings. Similarly, our post-tax reform, COVID-era migration remains in full force with many businesses, families and individuals continuing to migrate to the State of Florida for the reasons stated above, along with a business-friendly environment and no state income taxes.”

Parker further explains, “while there has been a reasonable and expected stabilization since the explosive migration and price escalation of 2022, there remains an insatiable appetite for housing in Florida. As we turn the corner into the fourth quarter, and notwithstanding our country being in an election year (typically synonymous with a real estate pause), we anticipate continued strength in the South Florida real estate market. This strength will be significantly bolstered should the Federal Reserve cut rates as anticipated in September and again into 2025.”

Nancy Batchelor of Compass noted, “South Florida continues to defy national housing trends with strong demand and prices. The stamp of approval from high-profile buyers including Jeff Bezos and Ken Griffin has really put Miami on the radar of every elite around the world. We expect this trend to continue, further solidifying Miami as a hub for luxury real estate, entertainment and lifestyle. Our market has proven to be extremely resilient and business migration to the area will continue to fuel growth.” She sees Miami Beach as being a particularly strong market, especially for luxury properties and high-end residential sales. “The area continues to attract demand from affluent buyers and benefits from strong tourism. The vibrant lifestyle, renowned beaches, and upscale amenities enhance its appeal to high-net-worth individuals and international buyers. Historically, during general election years we tend to experience a slowdown in October and November as people wait to see the results. However these transactions are usually delayed, not lost, leading to an increase the following year. Currently buyers and sellers are more focused on interest rates and insurance costs.”

Samantha Curry of Douglas Elliman highlighted that inventory for high-end homes and condos in South Florida has been “pretty tight.” She notes, “as soon as interest rates begin to decrease, I expect to see more listings come online as buyer demand starts to increase. Also, I anticipate an increase in listings after the election in November.”

When asked about any specific markets that she sees as being strongest, she says “Palm Beach Island is one of the strongest markets, with steady demand and low supply. Considering it is a fairly small island with tight building restrictions, typically demand will mostly always be higher than supply. Buyers, both from the U.S. and abroad, continue to be drawn to our tax benefits, growing job market (Wall Street South), attractive climate, safety/security, and amazing lifestyle. She added, “West Palm Beach is becoming more popular too, especially with younger, affluent buyers looking for luxury urban living. WPB recently introduced two new branded preconstruction projects including the Ritz Carlton residences and Mr. C Residences which are both very attractive to out-of-town and local residents.”

Jennifer Kilpatrick of the Corcoran Group sees the South Florida market remaining strong for the rest of 2023. She stated, “While interest rates and economic uncertainties may temper some of the market’s growth, luxury properties are likely to continue appreciating due to limited supply and high desirability. Overall, we anticipate a stable market heading into our fall and winter season, particularly in the high-end segment. Inventory levels in South Florida’s luxury real estate market remain relatively low, and we haven’t seen significant signs of a resurgence in listings. However, there is a gradual increase in new developments and renovations, which may slightly ease the tight supply. Nonetheless, demand continues to outpace supply, particularly in sought-after areas, keeping competition high among buyers.”

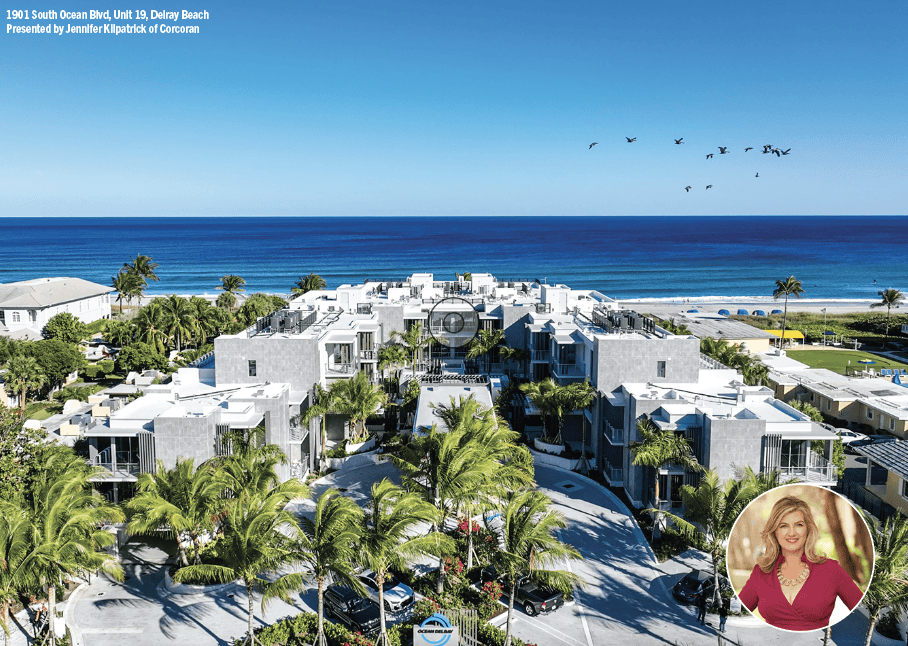

Kilpatrick added, “Luxury areas in Miami and Palm Beach remain perennial favorites and strong micro markets, while Delray Beach, Boca Raton and Fort Lauderdale are particularly strong, thanks to their appeal to high-net-worth individuals, looking for new homes, estate homes and unique waterfront properties. The growing interest in ultra-luxury condos and estates in these locations continues to drive prices upwards.”

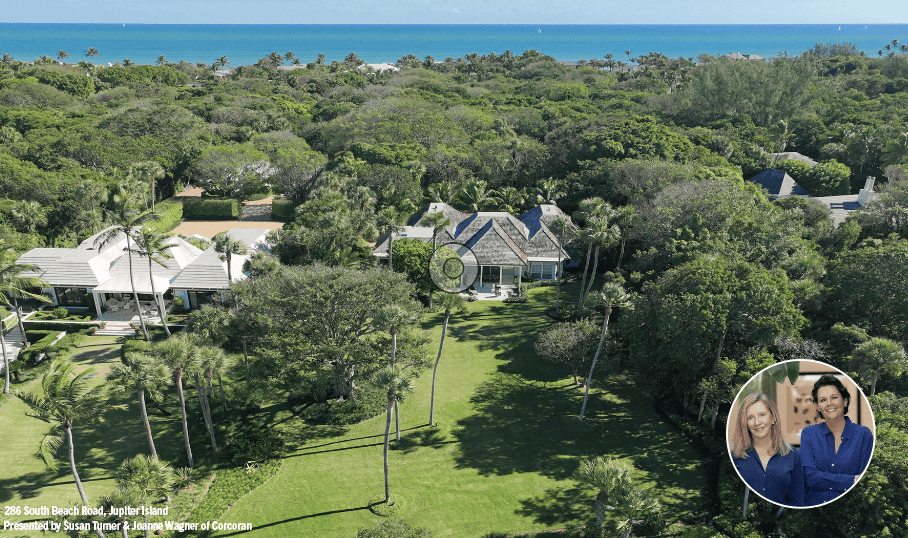

Susan Turner and Joanne Wagner of Corcoran’s Jupiter Island Team noted, “We expect the migration to South Florida to continue for the foreseeable future, regardless of the outcome in the November election.” When asked about the current inventory situation they tell us that the coastal South Florida market continues to see very low supply levels for the most desirable properties: “The high-end coastal market continues to be the strongest market in years. While a presidential election year typically has an impact on luxury real estate due to the uncertainly built into the financial markets, Florida is, to a certain degree, less affected by the outcome due to the fact that it remains a tax haven for luxury buyers. The team currently has an $18.9 million Hobe Sound oceanfront home under contract, confirming the strength of the South Florida coastal luxury market.

As summer concludes, the South Florida real estate market remains robust, driven by strong demand from both domestic and international buyers. Despite a stabilization following the 2022 surge, the region continues to attract high-net-worth individuals, fueled by its desirable climate, lifestyle, and tax benefits. Inventory remains tight, especially in luxury segments, but ongoing developments and renovations may provide some relief. Key markets like Miami, Palm Beach, and coastal areas are particularly resilient, with experts predicting continued strength into the fourth quarter and beyond, bolstered by potential Federal Reserve rate cuts and sustained migration to the state.

![Festive flavors, candlelit corners, and winter menus worth the splurge 🍷 This season’s dining scene brings elegant French favorites, seasonal seafood, and cozy classics to the East End table. Whether it’s brunch, dinner, or something in between, these spots are celebrating the holidays in style. [link in bio]](https://hamptonsrealestateshowcase.com/wp-content/uploads/sb-instagram-feed-images/589526657_18551254843030135_4235854489711269175_nfull.webp)

![Space reservations are closing soon for the Holiday / New Year Issue of Hamptons Real Estate Showcase 🎁 This double issue comes with expanded reach, now landing in South Florida as well. Start the new year with premium visibility among luxury homeowners from the Hamptons to Miami. [link in bio]](https://hamptonsrealestateshowcase.com/wp-content/uploads/sb-instagram-feed-images/588642217_18550541596030135_1974828802096238970_nfull.webp)

![Holiday hosting is all about the details 🕯️ This season’s tabletops mix nostalgic charm with fresh touches. Think layered textures, seasonal greens, and flickering candlelight. Whether it’s a quiet dinner or a festive feast, there’s beauty in every setting. [link in bio]](https://hamptonsrealestateshowcase.com/wp-content/uploads/sb-instagram-feed-images/587562593_18550195297030135_5307983913708101790_nfull.webp)

![There’s no shortage of thoughtful, design-forward gifts to discover across the East End this season 🎁 Whether you're shopping for a hostess, a homebody, or someone who simply loves beautiful things, we’ve rounded up a few local finds that are sure to surprise and delight. [link in bio]](https://hamptonsrealestateshowcase.com/wp-content/uploads/sb-instagram-feed-images/587623967_18550040371030135_5392968951052147490_nfull.webp)