The Region Remains One of the Most Desirable Real Estate Markets in the World.

South Florida’s luxury real estate market remains strong, drawing affluent buyers with its tax advantages, warm climate, and exclusive lifestyle. Despite high interest rates, low inventory sustains demand, as buyers seek both turnkey estates and high-potential investment properties. In 2025, purchasing a home here means more than just real estate — it’s an investment in prestige, innovation, and financial opportunity. The region’s world-class amenities, waterfront estates, and proximity to global business hubs make it an attractive choice for high-net-worth individuals. As more luxury developments emerge, South Florida continues to solidify its reputation as one of the most desirable real estate markets in the world.

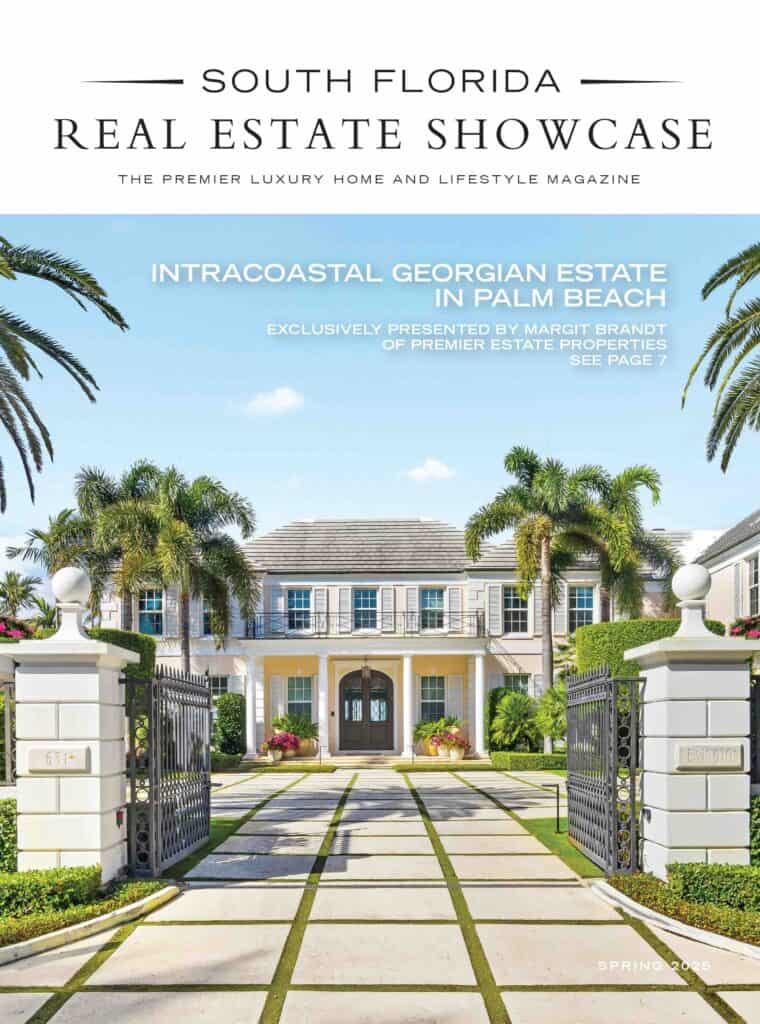

Represented by Margit Brandt of Premier Estate Properties

For our Spring market report, we turned to two of Palm Beach’s top real estate powerhouses — Margit Brandt of Premier Estate Properties and Dovi Ettedgui of Corcoran — for their expert insights on the trends driving South Florida’s luxury market. From record-breaking sales to shifting buyer preferences, here’s what they had to say.

In light of recent high-profile listings, such as the $285 million estate in Manalapan, how are ultra-luxury properties influencing the overall market dynamics?

Margit Brandt: The availability of more trophy estates and legacy-style compounds provides the wealthiest people in the world with more inventory to start to envision their presence in Palm Beach. It also signals to the marketplace the type of capital that the area is attracting, which has a sort of domino effect. For businesses to open here, we need to have the right residential products on the market (or off market but for sale) to attract the world’s most discerning and high-expectation buyers. There could potentially be a new asset class that may develop in 2025-2026 for the $150M+ marketplace — which just last year was an East Coast record that we set with our $152M transaction of Tarpon Island. More of these mega properties trading, especially if the parties include household names and established entrepreneurs/families, continue that snowball effect which encourages other buyers on the sidelines to get in on the action while they still can.

What significant trends are currently shaping the luxury real estate market in South Florida for 2025?

Dovi Ettedgui: South Florida’s luxury real estate market is basking in the glow of sustained and continued growth. Affluent buyers from the Northeast, Midwest, Canada, Europe, and California are trading in their chilly winters and high taxes for the Sunshine State’s stunning beaches and favorable tax climate. Among these discerning buyers, a clear contrast is emerging. Some are willing to pay top dollar for turnkey homes, complete with designer finishes and furniture. Others are on the hunt for properties that may need a little more TLC. These buyers believe that there’s a lot of value in unrenovated properties — allowing them to imbue their personal style and reap the rewards of appreciation without having to pay top dollar.

Despite high interest rates, motivated buyers are paying strong prices for their slice of paradise. The reason? Low inventory, paired with Florida’s no-state-income-tax policy. While there’s still so much of 2025 to unfold, one thing is clear about South Florida’s luxury real estate market: buyers aren’t just purchasing a home. They’re investing in a lifestyle that combines luxury, sophistication, and innovation — with a splash of sunshine.

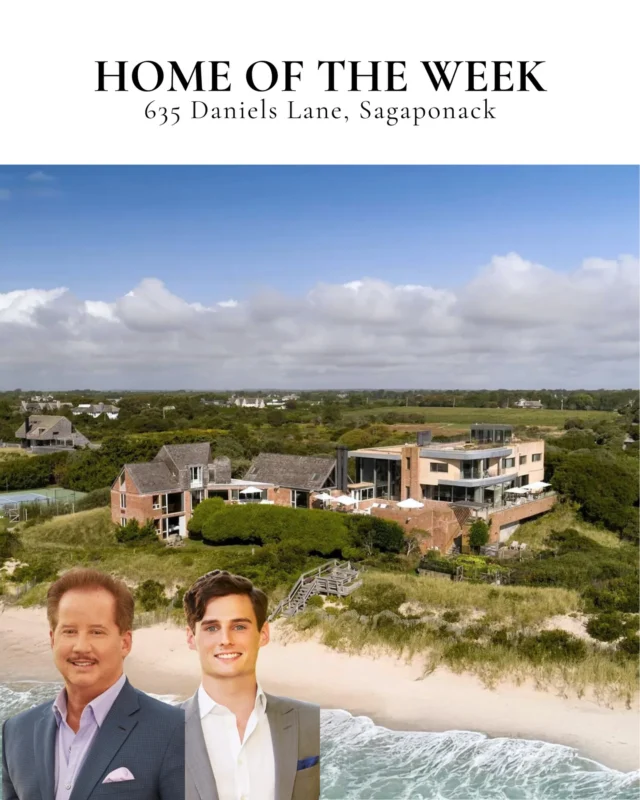

Represented by Dovi Ettedgui of Corcoran

What upcoming developments in South Florida do you see impacting property values in the luxury market?

Margit Brandt: The biggest thing for West Palm Beach is the creation of Related Ross, which will continue to develop the necessary housing and office space infrastructure, plus entertainment and amenities, to accommodate the pent up demand for thousands of more people to move to the West Palm Beach area. There is a backlog of private equity firms and hedge funds that want to open up offices here, but they do need high quality office space and housing for their teams. The growing condo market will help fill a lot of that void. The opening and expansion of private schools is also a necessity. Finally, the Vanderbilt campus has the ability to transform West Palm Beach into not just Wall Street South, which is already well underway, but also Silicon Valley Southeast, and for us to start competing with Austin, TX and Miami, etc. As the AI arms race intensifies, having a tech-forward campus like Vanderbilt provides endless opportunities for employers and opportunities to grow the local economy.

What advice do you have for sellers looking to maximize their property’s appeal in the South Florida’s competitive luxury market?

Dovi Ettedgui: I’d like to introduce a winning formula to unlock your property’s full potential. First, declutter and stage your property in a way that shows off its unique character, highlighting finishes, views, and layout. Next, it’s about pricing strategically, taking into account the competition and current market conditions. Buyers will evaluate your property value through three different lenses: price, condition, and location. Finally, it’s time to shine and list your property. Something I like to tell my clients, “Your property is never more valuable than the day it’s listed.” Aiming for the peak winter season, December through May, offers a great window of opportunity to capture snowbirds and international buyers who flock to this region. My pro tip: Invest in great professional photography and video to make a positive memorable impression.

Special thanks to Margit Brandt and Dovi Ettedgui for their invaluable insights. As South Florida’s luxury real estate market continues to thrive, the rise of ultra-high-end estates is reshaping the landscape. The influx of trophy properties is attracting elite buyers, fueling a ripple effect that extends beyond residential sales to business growth and economic expansion. With the potential emergence of a new $150M+ asset class, the region is solidifying its status as a premier destination for the world’s wealthiest investors. As more high-profile deals close, demand intensifies, making now a pivotal moment for buyers and sellers alike to capitalize on this evolving market of luxury, exclusivity, and long-term financial opportunity.

![Festive flavors, candlelit corners, and winter menus worth the splurge 🍷 This season’s dining scene brings elegant French favorites, seasonal seafood, and cozy classics to the East End table. Whether it’s brunch, dinner, or something in between, these spots are celebrating the holidays in style. [link in bio]](https://hamptonsrealestateshowcase.com/wp-content/uploads/sb-instagram-feed-images/589526657_18551254843030135_4235854489711269175_nfull.webp)

![Space reservations are closing soon for the Holiday / New Year Issue of Hamptons Real Estate Showcase 🎁 This double issue comes with expanded reach, now landing in South Florida as well. Start the new year with premium visibility among luxury homeowners from the Hamptons to Miami. [link in bio]](https://hamptonsrealestateshowcase.com/wp-content/uploads/sb-instagram-feed-images/588642217_18550541596030135_1974828802096238970_nfull.webp)

![Holiday hosting is all about the details 🕯️ This season’s tabletops mix nostalgic charm with fresh touches. Think layered textures, seasonal greens, and flickering candlelight. Whether it’s a quiet dinner or a festive feast, there’s beauty in every setting. [link in bio]](https://hamptonsrealestateshowcase.com/wp-content/uploads/sb-instagram-feed-images/587562593_18550195297030135_5307983913708101790_nfull.webp)

![There’s no shortage of thoughtful, design-forward gifts to discover across the East End this season 🎁 Whether you're shopping for a hostess, a homebody, or someone who simply loves beautiful things, we’ve rounded up a few local finds that are sure to surprise and delight. [link in bio]](https://hamptonsrealestateshowcase.com/wp-content/uploads/sb-instagram-feed-images/587623967_18550040371030135_5392968951052147490_nfull.webp)