The second quarter of 2023 has come and gone in a flash; still the South Florida marketplace continues to see a surge in domestic and international wealth migration, as homebuyers from high-tax, high-density states relocate and purchase prime properties of $1 million and up. The region’s real estate market is unique due to the significant number of cash transactions and the high rate of migration. The housing market in South Florida, particularly in Miami-Dade County, continues to show robust growth and resilience, outperforming pre-pandemic levels. According to the April 2023 statistics released by the MIAMI Association of Realtors (MIAMI) and the Multiple Listing Service (MLS) systems, the market is leading the nation in real estate appreciation.

For a more in-depth understanding of the strength of the South Florida markets (both macro markets and local micro markets), Hamptons Real Estate Showcase turned to a number of industry professionals for some insight on the following questions:

HRES: What’s in store for the balance of the 2023 market in South Florida?

Candice Friis, located in the Delray Beach office of Corcoran, believes that the outlook for the balance of 2023 appears promising. “With prices continuing to surge, strong employment numbers, and easing inflation concerns, the worries of a recession seem to be subsiding,” shares Ms. Friis. “The market’s strength can also be attributed to other factors, including the region’s attractive lifestyle, favorable tax environment, and sustained demand from luxury buyers.”

Kevin Condon, with Sotheby’s International Realty, speaks to the issue as it relates specifically to the Palm Beach area. “The market in South Florida especially for Palm Beach will continue to remain strong throughout 2023 and into 2024. While sales volume and number of transactions have declined compared to this time last year, property values are still remaining high due to limited inventory. The wealth migrating out of California and New York continues to bring buyers relocating their families and businesses to our area. While these trends continue, property values will remain strong.”

Also weighing in on the strength of the Palm Beach micro market, John Cregan of Sotheby’s Cregan Team agrees that housing demand in the Palm Beach area market is always driven by out of state buyers. “Many are vacation home buyers,” Mr. Cregan explains, “but for the more expensive properties and single family homes, our buyers are typically refugees from high-tax/cold weather states taking up permanent residence….That provides a floor under Florida prices and we think sales activity will pick up again once our buyers tie up their summer travels.”

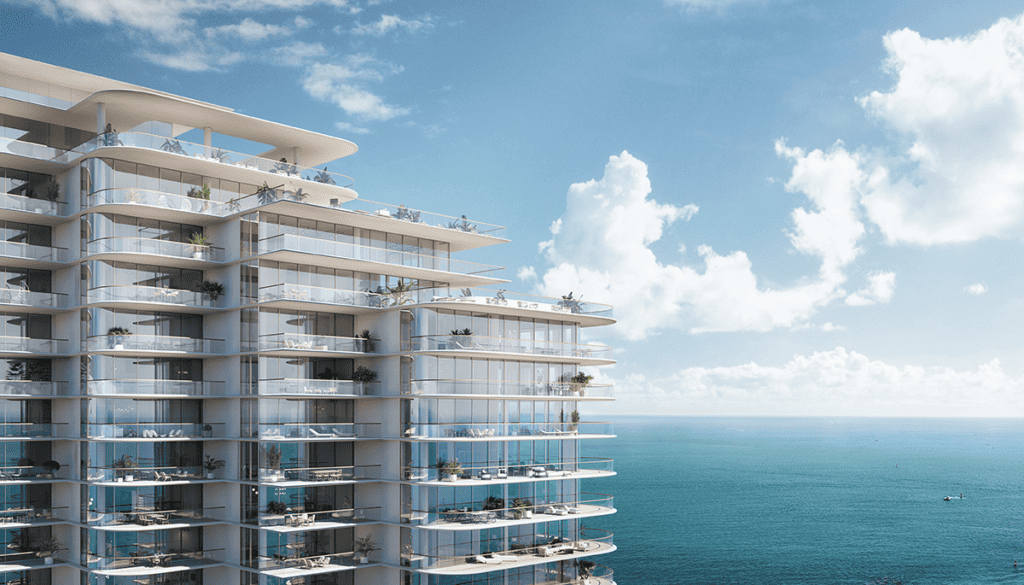

The Perigon is a new beachfront development of luxury condos in Miami Beach. Philip Freedman, director of sales for The Perigon, concurs that the South Florida marketplace – particularly Miami Beach – will continue on an its current upward trajectory. “More and more, buyers and investors alike continue to be bullish and are contributing to South Florida’s success as more companies expand into the market and fuel its growth.”

Specifically, Mr. Freedman speaks to the success of his development project. “The Perigon has seen tremendous success with sales, year to date, with strong activity from domestic buyers in the first half of the year. Typically, activity slows down in the summer season, but our project has been performing well which is a true testament to the valuable long-term investment this offering represents to our buyers.”

HRES: What about supply? There has been a reported lack of supply for at least the last 6-8 quarters. Do you see the lack of supply as one of the factors propping up the strong South Florida market?

John Cregan leads off, stating that while housing supply remains historically low, the market has seen a bit of an increase since the pandemic. “We’ve had a pretty good bounce-back from our supply lows. Condos and single-family home listings are roughly double the numbers of late 2021/early 2022 listings, though still only about half the normal pre-Covid supply.”

“Yes, our supply still remains well below pre-pandemic inventory levels,” confirms Kevin Condon. “The last two quarters we have seen inventory increasing giving buyers in the market more options to consider but the lack of supply is definitely one variable keeping prices up.”

And what’s changing for the better because of the increase in supply? Negotiability. “We are seeing some negotiability off the asking price and more favorable terms written in the contract. The balance of power has equaled out between buyers and sellers,” shares Condon.

However, the Cregan Team adds a proviso: “We’d also note supply is not evenly distributed. We had a busy season of sales in Palm Beach’s better condo buildings. And superhigh-end waterfront houses sold easily, no matter the price. Where there’s very good availability is in the middle of the market – the nice family home in a good neighborhood. That holds true everywhere from Palm Beach’s North End, to SoSo and El Cid in West Palm, to Jupiter Island and Hobe Sound.”

“Whether it’s new construction or renovations, demand for South Florida property is stronger than it’s ever been,” states Jon Paul Perez, the President of Related Group, which is based in Miami and is Florida’s largest developer and one of the country’s largest Hispanic-owned businesses. “There are locals who are opting to sell their Miami home in order to upgrade to a bigger residence or enter a new neighborhood. We’re also seeing out-of-towners come and purchase a residence they plan to grow into. No matter how you look at it, supply is tight and competition for existing listings and pre-construction units is high.

“To put it into perspective, at Related, we have more than 10 active condo projects selling right now including The Residences, Six Fisher Island; Baccarat, Brickell; Casa Bella, Downtown Miami, NoMad Residences, Wynwood; Rivage, Bal Harbour; Rosewood, Hillsboro Beach, with more set to launch later this year. Despite competing with existing inventory, Baccarat Residences Miami is approaching sell-out with other developments like Casa Bella and NoMad Residences close behind. Beyond focusing on high-end condos, Related has also made strides in the market by building best-in-class luxury rentals that have redefined markets. We capitalized on the growing demand for high-quality rentals because of a lack of supply for a sophisticated group of customers who wanted the exclusivity of a luxury condo with the flexibility and convenience of an apartment. Our formula was simple: provide a high-end residential experience while providing a five-star amenity package customers didn’t know was possible. Calling this new demographic ‘renters by choice,’ we seek to attract those who can afford to buy, but prefer to rent. A perfect example is Icon Marina Village, our newest elevated rental property in West Palm Beach boasting designs by Arquitectonica and interiors from V Starr, founded by tennis superstar Venus Williams.”

HRES: What about renovations? Are homeowners sitting tight and renovating in lieu of participating in the marketplace?

Candace Friis gets granular on the question of renovation/upgrade vs. purchase/sale. “Initially, property owners were hesitant to undertake renovations due to supply chain issues during the pandemic. However, the current trend is reversing as the supply chain improves. With the alleviation of supply constraints, renovating has become a viable and attractive option for homeowners looking to upgrade their existing properties and create personalized living spaces. Additionally, with higher interest and persistently low inventory renovating is a viable alternative for some while others will wait for the right property and scoop it up immediately when it hits the market regardless of interest rates as they just don’t want the hassle of renovating.”

“It depends on the scope of work that is required and the seller’s primary goal,” reports Kevin Condon. “While the supply chain is improving for taking on projects, buyers today are also looking for immediate satisfaction. As buyers are becoming more selective, sellers will take on certain projects that are quick and cost effective in order to bring their home to market in the best possible condition. Because the demand is so high and inventory is so low, it has caused some homeowners to remain in place and make those upgrades needed on their home.”

John Cregan speaks to this question as it relates to the Palm Beach micromarket. The materials, contractor and subcontractor bottleneck seems to be easing. There’s still high demand but availability is improving. We don’t often see homeowners here renovate to fill a need – instead they tend to trade up and there were a lot of Palm Beacher to Palm Beacher swaps this season….More often, renovations get taken on by new buyers or speculators looking to fix and flip. We’ve also seen owners of older homes choose to sell ‘as is’ and move to the fabulous new luxury condos on the West Palm Beach waterfront like La Clara and The Bristol.”

HRES: Can the strength of the South Florida real estate market be tied to all of South Florida as a whole? Or just certain micro markets? If so, which micro markets are supporting the balance of the market in general?

South Florida is nuanced, and the market can’t be generalized to the entire region,” answers Philip Freedman. “Coastal Florida, like The Perigon’s perfectly positioned location between the sands of Miami Beach and expansive Biscayne Bay with views of the Miami skyline, is the strongest market of them all, and where prices have remained consistent or increased. Both the east and west coasts continue to see greater demand in the luxury market because of the limited oceanfront property available. As a result, we’ve seen an overall increase in price coupled with an increase in transactions.”

Candace Friis concurs. “Absolutely, the strength of the South Florida real estate market can indeed be attributed to a combination of both the region as a whole and certain micro markets within it. South Florida is a diverse area with distinct neighborhoods offering unique dynamics, architectural styles, amenities, and water access. These differences contribute to the creation of various small micro markets, each catering to different preferences and lifestyles. From bustling urban areas to serene waterfront communities, South Florida has something for everyone, making it an attractive destination for a wide range of buyers. The beauty of the real estate market lies in its ability to accommodate diverse needs, allowing individuals to find their perfect home in the micro market that resonates with their lifestyle and desires.”

Jon Paul Perez is very bullish. “South Florida has firmly established itself as one of the most desirable real estate markets in the nation, and its popularity shows no signs of waning, even as other regions experience a cooling off. The secret to its allure lies in several key factors driving its appeal. Firstly, the region’s irresistible tax benefits make it a top pick for both buyers and investors, creating a win-win situation for all. Additionally, the stable economy, fueled by continuous job growth, further bolsters its appeal as a prime real estate market in the nation.

Beyond financial perks, South Florida offers an enchanting lifestyle with its world-class beaches, vibrant cultural scenes and a dining scene that’s second to none. Outdoor enthusiasts are spoiled for choice with an abundance of activities, making it a dream destination for those seeking luxury and enrichment.”

![Enter into turnkey luxury at 8 Valley Road! This stunning home blends design perfection with natural Hamptons light. Featuring 6 bedrooms, 5.5 baths, a heated gunite pool, and an EV-ready garage, every detail has been thoughtfully crafted. Represented by Timothy O'Connor and Jeffrey Carter of @brownharrisstevens. [link in bio]](https://hamptonsrealestateshowcase.com/wp-content/uploads/sb-instagram-feed-images/467186038_596799599355870_7587513084497571115_nfull.webp)

![Treat yourself to an unforgettable evening this Sunday, November 17th, at @sensagharbor 🍣🍸 Indulge in chef-curated courses featuring luxurious caviar, rich Wagyu beef, and perfectly paired wines from @paumanokvineyards. A night of indulgence and elegance awaits—don’t miss this exclusive culinary experience! [link in bio]](https://hamptonsrealestateshowcase.com/wp-content/uploads/sb-instagram-feed-images/467184544_1766493134164226_6024859026051554135_nfull.webp)

![Homeowners are faced with the daunting task of choosing the right kitchen design — one that will remain timeless for both entertaining and day-to-day functionality. With a focus on luxury, clients are increasingly leaning towards clean, modern aesthetics but are hesitant to embrace a fully contemporary look. [link in bio]](https://hamptonsrealestateshowcase.com/wp-content/uploads/sb-instagram-feed-images/467244043_1082221510295882_2208387561574057218_nfull.webp)

![Experience the epitome of coastal country living in this newly constructed, quality craftsmanship waterfront home on James Creek, leading to Peconic Bay. With 80± ft. of prime waterfront, 4060 Ole Jule Lane showcases thoughtfully landscaped grounds, a bluestone patio, outdoor shower, and a refreshing saltwater pool. Represented by @nataliealewis of @coldwellbanker. [link in bio]](https://hamptonsrealestateshowcase.com/wp-content/uploads/sb-instagram-feed-images/467188671_18474458155030135_7164624532118372206_nfull.webp)

![Welcome to 122 Mill Pond Lane, an impeccably conceived and meticulously maintained residence in a dramatic west-facing setting on Mill Pond. Throughout the home are thoughtfully considered elements that reinforce the home’s clean, modern sensibility. Represented by @kraelyllahamptons of @hamptonsrealestate. [link in bio]](https://hamptonsrealestateshowcase.com/wp-content/uploads/sb-instagram-feed-images/466787127_18474263443030135_2753720635361764689_nfull.webp)

![Perched atop the dunes at Louse Point sits 2 picturesque homes at 88 & 86 Louse Point Road, both perfect for enjoying all seasons that East Hampton has to offer. Each thoughtfully designed home maximizes the topography to allow seamless indoor/outdoor living and entertaining. Represented by @petrieteam of @compass. [link in bio]](https://hamptonsrealestateshowcase.com/wp-content/uploads/sb-instagram-feed-images/466619407_18473886082030135_7330054085188815713_nfull.jpg)

![Get cozy every Friday at Canoe Place Inn! 🍫🔥 Gather around the fire on our Garden Lawn for Fireside Fridays all season long, where evenings are warmed up with hot cider, hot chocolate, s’mores, and cocktails. Enjoy live acoustic music on select dates, and with your first drink, receive a complimentary s'mores kit! [link in bio]](https://hamptonsrealestateshowcase.com/wp-content/uploads/sb-instagram-feed-images/466374901_1761070534297706_6837753985329213061_nfull.jpg)