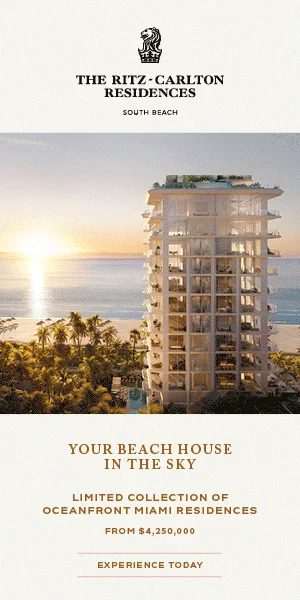

Resilient South Florida Market Continues to Boom

One of the most startling statistics to come out of South Florida: the median price of single family homes in southeastern Florida has been on an upward trajectory for the past 144 months. For those of us who have to do the math on a double take: that’s twelve years of continual median price increases!

Twelve years of median home price increases in the southeastern Florida market seem almost unbelievable – but maybe not so much, given that the last 4 years in the Covid/post-Covid marketplace has shown unprecedented growth and volume in Florida residential real estate. South Florida is the seventh-largest metropolitan area in the United States and the second-largest in the southeastern United States, trailing only the Washington-Arlington-Alexandria metro area. More than 6.7 million people live in the region, which encompasses more than 6,000 square miles and three counties: Miami-Dade, Broward, and Palm Beach.

Gay Cororaton, Chief Economist at MIAMI Realtors® drills down into the numbers and forecasts a positively rosy outlook for Southeast Florida’s home sales, identifying 5 major market trends in 2024:

Downward trending mortgage rates. Cumulative rate cuts by the Fed, combined with slowing inflation may lead to the 30-year rate hitting a projected 5.25%, down from the high of 6.8% in 2023.

Increase in existing home sales. The decline in mortgage rates will likely cause a bounce in existing home sales, with projected growth of 7%. Single-family home sales are projected to increase 8%; condominium sales are projected to increase 5%.

Increase in home prices. Home prices will continue to rise at the more modest pace of 5% – a number that seems comparatively soft to the cumulative price gains of over 50% since 2019.

Housing supply will remain tight. According to Cororaton, supply will remain steady at below 6 months, with tighter market conditions for single-family homes than condominiums. 2024 will remain a seller’s market in 2024 with 3 to 4 months’ supply as lower mortgage rates bolster demand while supply does not adjust as fast.

Market competition will increase. Demand will remain high across all market segments and demand will be particularly robust in the $1 Million plus market and the high luxury market. Supply has increased to about 18-24 months in the $1 Million plus market, which is on par with pre-pandemic levels.

Contributing to the continuing uptick in the South Florida market is Florida’s “resilient and dynamic economy.” Cororaton asserts that the strength of South Florida’s housing market is underpinned by Florida’s sustained out-of-state and international migration induced by Florida’s low business taxes and no state income tax, and the continuing recovery of domestic and international tourism and travel. Furthermore, the one point reduction of the business rent tax (the “BRT”) from 5.5% to 4.5% also seems to be fueling the strong Florida economy. The BRT is the sales tax levied on Florida businesses renting or leasing commercial property.

Over the past year, 23% of foreign buyer transactions in the United States occurred in Florida, resulting in Florida’s designation as the top destination for foreign buyers. The surge in local home prices in South Florida is closely tied to this phenomenon of wealth migration. According to Cororaton’s analysis of the 2020-2021 migration data released by the Internal Revenue Service, in-migration contributed significantly to the region’s economic landscape. In 2021, South Florida’s household income experienced a remarkable boost of $16 Billion.

Cororaton also forecasts a positive outlook for Florida home sales in 2024. With an anticipated 7% year-over-year expansion by the end of 2024, driven by a decline in mortgage rates to 5.25%, the market seems poised for growth. Cororaton predicts that prices will continue to appreciate at a modest pace of 5%, with varying impacts across different market segments. “In the low to mid-price segment of the market, the lower mortgage rates will drive up demand from first-time buyers and renter households. In the high-price and luxury segment, the wealth effect from rising stock prices, a pickup in economic growth in 2024, and sustained migration of high-income households into Southeast Florida will push up demand,” explains Cororaton. Inventory for single-family homes stands at 4.4 months, signaling a seller’s market; condominium supply is 6.8 months, which may indicate the movement to a buyer’s market. New listings are up across all markets.

All of that information is great – but how does it translate to specific markets within South Florida? For Palm Beach and West Palm Beach, Hamptons Real Estate Showcase turned to the Cregan Team of Sotheby’s Palm Beach office for a little more color. “Palm Beach is idiosyncratic,” shares John Cregan, “the market doesn’t have much to do. The Palm Beach/West Palm market has been ‘flat-ish’ since Spring 2022. Sellers who are not overreaching and pricing properties correctly – or even at a little bit of a bargain – those properties are moving quickly.”

“Our core market in Palm Beach is $2M -$5M for condos and $8M-$14M for houses. Price-wise, we are roughly at 2022 levels. That being said, it’s important to note these levels are roughly double the pricing we saw pre-Covid.” As for inventory, Cregan notes that it’s moving up – if only slightly. “Inventory is creeping up. High prices are bringing out more sellers, and because this past summer was quiet, there’s a little more inventory to look at. The pace of sales is slower too: net-net we are looking at more inventory. Still, we are only at about 60-70% of pre-covid supply levels.”

“Buyers are back and engaging, interest rates really do affect affordability,” states Jennifer Kilpatrick of Corcoran’s Delray Beach office. “Something as small as a single interest rate point reduction is enough to get people engaged and back in the market. It seems like most buyers feel like this downward movement in interest rates is the trend, and it’s encouraging those who have been sitting on the sidelines.” Kilpatrick also sees the market stabilizing.

“Unrealistic sellers are getting realistic about pricing. The market is normalizing, stabilizing – and that’s a good thing. It feels like a pre-Covid market, with well-priced homes selling for 94% to 96% of list price – as opposed to 100% plus.” Kilpatrick has a caveat, however: “Current pricing is certainly higher than before Covid, but the sellers are now more realistic and not trying to push the needle to make the prices higher. It’s a good time to buy if you’re a well-educated buyer.”

As a takeaway, the Cregan Team notes that there’s a premium for new construction, but there’s a way to find some housing at ‘relatively reasonable’ pricing. “There’s really good demand for new construction – it’s been the easiest thing to sell for the past year and a half. But anyone who wants to do a little work, a relatively minor project like a garage, can find great opportunities at a big difference in pricing.”

“2024 is going to be a good year, a solid year in Palm Beach,” shares Todd Peter of the Sotheby’s Frances and Todd Peter Team. “More listings are coming to the market; days on market have increased, but deals are getting done. Buyers are just taking more time.”

Peter continues that the strength of the South Florida real estate market cannot be understated – especially Palm Beach. “The secret is out: everyone knows Palm Beach and wants to be there. People are leaving other cities and places and coming to Palm Beach. And Palm Beach is an island: there’s a finite amount of real estate and seemingly infinite demand.” Peter’s takeaway on 2024: “I would not be shorting South Florida.”

![Next weekend, the Hamptons International Film Festival returns with a powerful slate of films, global premieres, and community connection. 🎬 From narrative dramas to groundbreaking documentaries, this East End tradition brings the art of cinema to life in unforgettable ways. [link in bio]](https://hamptonsrealestateshowcase.com/wp-content/uploads/sb-instagram-feed-images/553311384_18536395384030135_7815196520249715018_nfull.webp)

![Picnic season isn’t over just yet. From crisp whites to collapsible tables, a few well-chosen essentials can turn any outdoor moment into something special. We’ve curated a list of favorites to help you make the most of every last warm day. [link in bio]](https://hamptonsrealestateshowcase.com/wp-content/uploads/sb-instagram-feed-images/550776784_18534662161030135_2052866662940107332_nfull.webp)

![Seaside gardens are more than just beautiful, they’re built to endure. With the right plants, structure, and intention, coastal landscapes can thrive in even the toughest conditions. Designers share how to blend aesthetics with resilience for a garden that’s both striking and sustainable. [link in bio]](https://hamptonsrealestateshowcase.com/wp-content/uploads/sb-instagram-feed-images/552039742_18534454579030135_6181491184247772098_nfull.webp)