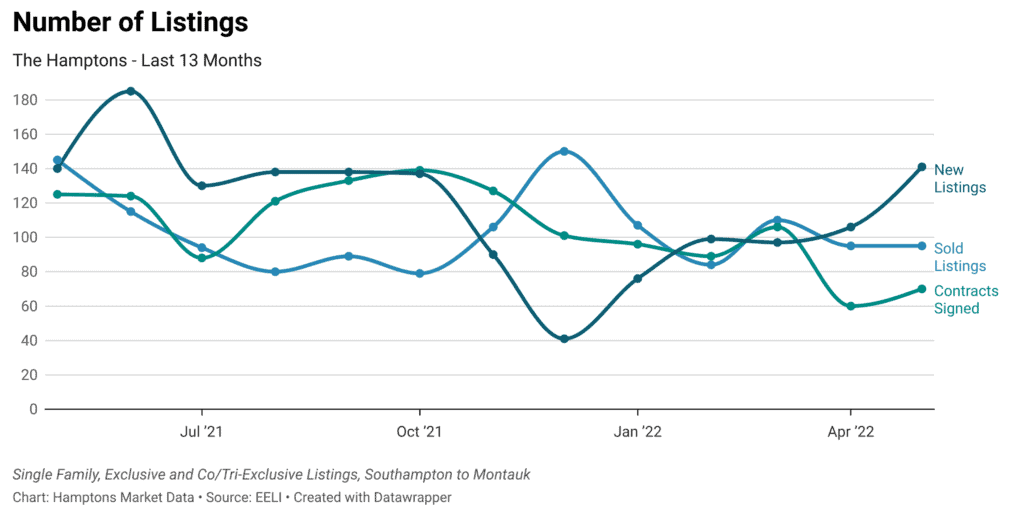

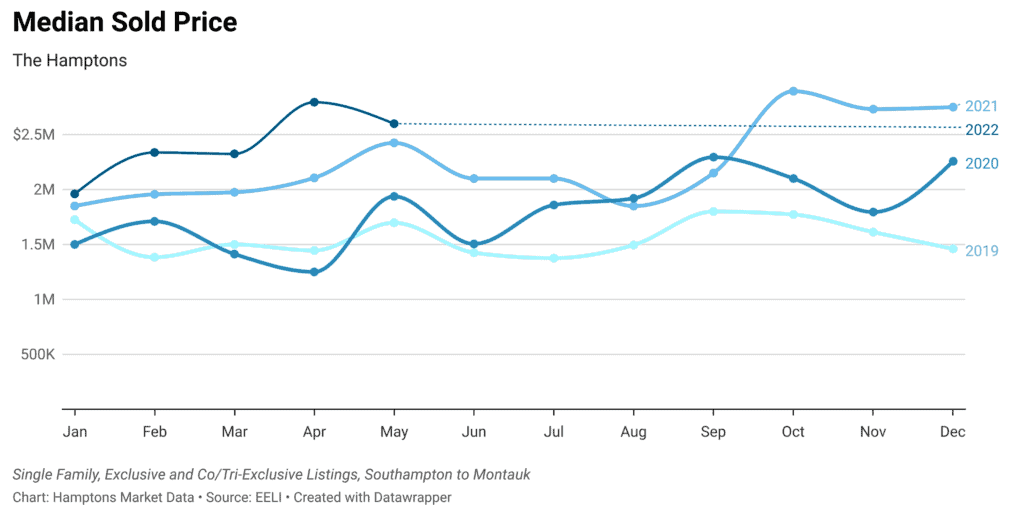

The number of listings available for sale began to increase in April of 2022 and the number of signed contracts remained low to recent norms going into summer 2022. However, the number of sold listings is in keeping with historical norms while the median sold price remains at historic highs.

The discount on listings that have recently closed has also been historically low with sellers holding out for their prices amidst growing inventory for sale. Apples are not oranges and though the total number of listings for sale has increased a touch, and contract activity will always follow suit in some fashion, many prospective buyers are secure in their summer plans and are patiently waiting to see what may unfold and for the right home to become available.

There could be more options in the fall market or patient buyers could wind up competing fiercely again with buyers who opted to skip renting this summer to gain more purchase power in saving for bigger upcoming down payments or a higher purchase price. Mortgage bankers still report competing with cash buyers and that most mortgages are currently around 50% loan to value.

Though the number of new listings has increased, the market supply of available properties remains depleted, and many prospective buyers remain disappointed in the options available in their particular sector of the market.

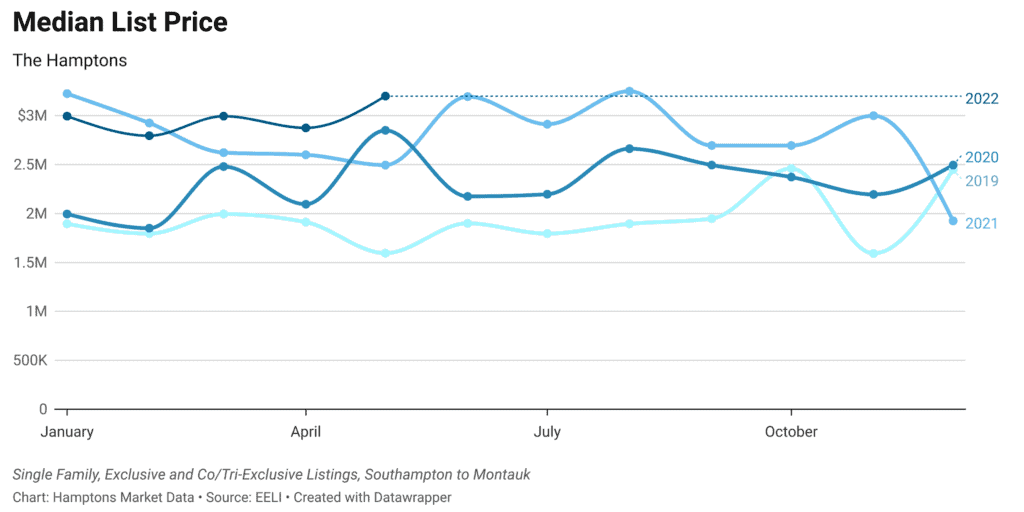

The median new listing price was $3,200,000 in May 2022 which was the third highest recent monthly new listing price behind January and August 2021. As inflation continues to impact the economy, sellers expect buyers to meet their prices and, given the listing discount at -1.17% off the list price, many buyers are happy to meet sellers at their prices.

However, old listings are reappearing on the list of available supply. Many new listings are not in fact new and are simply relisted. There are also properties that have shifted their pricing around — up and down — as sellers and agents attempt to figure out pricing in the Hamptons marketplace.

366 & 376 Gin Lane in Southampton listed by Harald Grant of Sotheby’s International Realty was originally listed in 2016 and remains available for sale today. It has been listed for $135 million, $145 million, $110 million, $94 million, and $140 million respectively.

Presented by Harald Grant of Sotheby’s International Realty

20 Edwards Hole Road in East Hampton listed by Nicole Tunick of Douglas Elliman was originally listed in 2017 and the pricing history remains unclear.

Presented by Nicole Tunick of Douglas Elliman

90 Denise Street in Sag Harbor listed by Nicole Tunick of Douglas Elliman was originally listed in 2017 and has had varied prices of $1.6 million, $1.75 million, $1.55 million, $1.45 million, $1.65 million, $1.85 million, $1.975 million, and now $2.595 million.

Presented by Nicole Tunick of Douglas Elliman

9 Quarty Circle in East Hampton co-listed with JP Foster of Town & Country and Lynda Packard of Douglas Elliman was originally listed in 2015 and has had varied prices of $1.75 million, $1.895 million, $1.695 million, and now $2.75 million.

Presented by JP Foster of Town & Country and Lynda Packard of Douglas Elliman

When a home is not selling, it is typically prudent to lower the price unless an obvious value add was made.

Adrianna Nava is the founder of Hamptons Market Data and Licensed Real Estate Broker with Compass.

![At @inspirseniorliving, they’re transforming senior living and elevating every dimension of life. With a philosophy that embraces enhanced wellness and immersive experiences, their communities offer residents a lifestyle that meets and exceeds everything they’ve envisioned for their lives; including Assisted Living, Memory Care, or Enhanced Care. [link in bio]](https://hamptonsrealestateshowcase.com/wp-content/uploads/sb-instagram-feed-images/452692090_1818077558601184_7837181803899896025_nfull.jpg)

![A winding private drive leads the way to 198 Two Holes of Water Road, situated on 10± acres with plenty of seclusion, privacy, and an all weather tennis court. After undergoing a top-to-bottom renovation in 2019, the estate has been marked by dramatic sculptural touches, wide expanses of scenic space, and is ready for immediate occupancy. Represented by @tomcavallo of @douglaselliman. [link in bio]](https://hamptonsrealestateshowcase.com/wp-content/uploads/sb-instagram-feed-images/452714375_18452144299030135_7245639606158274147_nfull.jpg)

![When Brooke Abrams undertook the interior decoration of an ultra-modern beach house designed by Bates Masi + Architects, her clients wanted everything to look very "rich and luxurious." In addition to unifying the interior space with the exterior space, Abrams sought to bring a sense of cohesiveness to the house. “It had a lot of beautiful pale woodwork in creams and beiges and greys,” she recalls. “Rather than introduce new colors, I felt it was important to stay within that neutral palate so that everything felt integrated.” [link in bio]](https://hamptonsrealestateshowcase.com/wp-content/uploads/sb-instagram-feed-images/452279191_374759435318292_2948881216648686178_nfull.jpg)