Hamptons Market Remains Very Active Heading Info Fall 2021

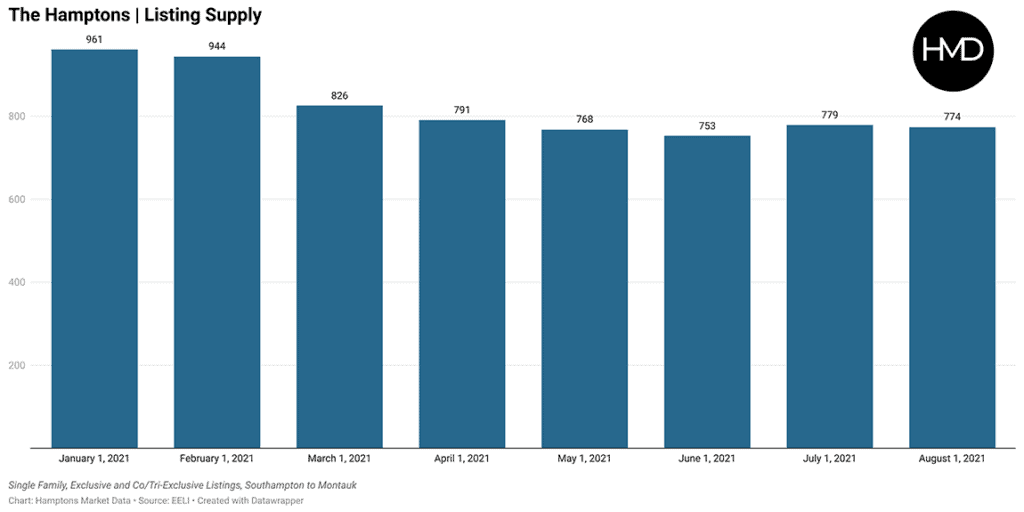

New listings, contracts signed and sold listings declined from June to July 2021 and listing supply decreased slightly by 0.7% going into August 2021. The less than $3 million market remains a tight buyer market, with few available listings compared to demand, while movement has been stable in the $3 – 4.999 million range. The $5M+ market has seen more new listings come on the market than go into contract; however, contracts signed for properties $10M+ have been steadily increasing since May 2021. Overall, the market remains very active compared to normal market activity levels.

The median sold price in July 2021 saw a 13% increase to $2.1 million over July 2020’s $1,859,000, and remained steady from June to July 2021 holding at $2.1 million.

< $1.5 million

From May through July, this price point had ninety-seven new listings enter the market, while ninety went under contract. In East Hampton, forty-six properties were new to the market, while forty-nine went under contract, and Sag Harbor was dead even with fifteen new properties coming on the market and fifteen going under contract.

19 4th Street in East Hampton was listed by Adriel Reboh of Compass. It went into contract in 25 days and closed in late July for $880,000, 14% above the $775,000 asking price.

3858 Noyack Road in Sag Harbor was listed by Susan Lahrman of Saunders & Associates. It closed in ninety-seven days, but was unable to break $1 million, closing for $980,000, an 11% discount from its $1.1 million last asking price and 22% below its original $1.25 million list price.

$1.5-2.99 million

From May through July, this price point had one hundred and forty-five new listings enter the market, while one hundred and fifteen went under contract. In Montauk, nine properties were new to the market, while eight went under contract, and Southampton had thirty-nine new properties come on the market, while twenty-three went under contract.

175 Greenwich Street in Montauk was listed by Chris Coleman of Compass. It went under contract in 16 days and closed mid-July for $1.65 million, 3.5% above the $1.595 million asking price.

8 Carriage Lane in Southampton was listed by Nancy McGann of Town & Country. It was originally listed in July 2020 for $1.85 million, but closed for $1.68 million, 4% below the $1.75 million last asking price and 9% below the original asking price.

$3-4.99 million

From May through July, this price point saw ninety-four new listings enter the market, while sixty went under contract. In Sag Harbor, seventeen properties were new to the market, while ten went under contract. In Water Mill, seven new properties came on the market and nine went under contract.

27 Palmer Terrace in Sag Harbor was listed by Michael Daly of Douglas Elliman. It was originally listed in October 2020 for $3.995 million, but closed for $3.1 million, 11.3% below its $3.495M last asking price and 22.4% below the original asking price.

118 Water Mill Towd Road in Water Mill was listed by Patricia Garrity of The Corcoran Group. It went under contract in 79 days and closed in late July for $4.3 million, 5.5% below its $4.55 million last asking price and 9.5% below its highest price of $4.75 million.

$5-9.99 million

From May through July, this price point saw seventy-one new listings enter the market, while forty-seven went under contract. In Sag Harbor, eight properties were new to the market, while six went under contract, and Bridgehampton had six new properties come on the market, while seven went under contract.

1802 Noyac Path in Sag Harbor was listed by Frank Bodenchak of Sotheby’s International Realty. It closed in 95 days in mid-July for $8 million, 0.1% above the $7.995 million asking price.

19 Landsdowne Lane in Bridgehampton was listed by Meghan Darby of The Corcoran Group. It went under contract in 21 days and closed late July for $5.505 million, 5.97% above the $5.195 million asking price.

$10+ million

From May through July, this price point saw forty-eight new listings enter the market, while twenty-three went under contract. In Southampton, five properties were new to the market, while two went under contract, and Wainscott had four new properties come on the market, while two went under contract.

33 LInden Lane in Southampton was listed by John Vitello of Brown Harris Stevens. It went under contract in 270 days and closed in early July for $11.65 million, 1.3% below the $11.8 million last asking price.

15 Wainscott Stone Road in Wainscott was listed by Beate Moore of Sotheby’s International Realty. It went under contract in 17 days and closed in mid-May for $11.5 million, at its asking price.

There has been a shift in favor of new construction or new renovation compared to this time a year ago. It

was important for buyers to be able to move right into a home, resulting in new but lightly lived-in homes performing the best in 2020. In 2021, while newer homes continue to remain popular and increase in price, new construction has gained popularity as buyers have settled down from many of 2020’s uncertainties.

Neighborhoods like Clearwater Beach in Springs, East Hampton and the bay beach communities just north of Noyac Road in Southampton and Sag Harbor continue to perform very well, as do homes that offer special views or access to natural features like water views, and also full sets of amenities, like a tennis court.

The number of days to contract increased 42% in July when compared to June 2021, but were down 52% from July 2020’s 309 days to contract. Price positioning measured against supply in a property’s area and price point will determine whether properties continue to go into contract in record days or the days to contract will steadily increase as sellers continue to have high pricing expectations and buyers wait to hold out for the right home to become available for sale.

To learn more about specific areas and price points in the Hamptons, including charts and stats, please visit HamptonsMarketData.com.

Adrianna Nava is a Hamptons real estate market and transaction expert who has her associate broker license with Compass. She is also the founder of HamptonsMarketData.com.

!['The Maples' is a prestigious generational compound of two extraordinary estates: 18 Maple and 22 Maple. This rare offering, designed by luxury architect Lissoni partners New York and developed by visionaries Alessandro Zampedri-CFF Real Estate and JK Living, redefines opulence with the highest quality of craftsmanship and captivating views of the Atlantic Ocean. Represented by @nycsilversurfer and @challahbackgirl of @douglaselliman. [link in bio]](https://hamptonsrealestateshowcase.com/wp-content/uploads/sb-instagram-feed-images/438891010_1083749139481747_7890082604579275354_nfull.jpg)

![Featuring 360-degree water views on Mecox Bay, the Atlantic Ocean and Channel Pond, 1025 Flying Point offers the ultimate beach cottage that is flooded with natural light. With panoramic views, proximity to the ocean, and a private walkway to Mecox bay for kayaking or paddle boarding, this truly is a special retreat. Represented by @ritcheyhowe.realestate and @hollyhodderhamptons of @sothebysrealty. [link in bio]](https://hamptonsrealestateshowcase.com/wp-content/uploads/sb-instagram-feed-images/438994305_737511778456166_4602476013493875279_nfull.jpg)

![Attention advertisers! 📣 Secure your spot in the highly anticipated Memorial Day edition #HRES. Reach thousands of potential clients and showcase your brand in one of the most sought-after publications in the Hamptons, NYC, Palm Beach, and beyond. Contact us now to reserve your ad space! [link in bio]](https://hamptonsrealestateshowcase.com/wp-content/uploads/sb-instagram-feed-images/438549843_275102939023235_6718257301437562124_nfull.jpg)

![You eat with your eyes, and on the East End, it’s important that what you eat looks just as good as how it tastes. At @rosies.amagansett, the restaurant itself is plenty photo-worthy with blue ceramic tiling and yellow and white striped fabric wallpaper. But for a dish that will light up your photos, head directly to the salmon tartare! [link in bio]](https://hamptonsrealestateshowcase.com/wp-content/uploads/sb-instagram-feed-images/437094269_7296727147115953_1594410326824303644_nfull.jpg)

![We were honored to be the media sponsor for @blackmountaincapital's open house event with @jameskpeyton and @jfrangeskos at 11 Dering Lane in East Hampton! Other sponsors included @landrover, Feline Vodka, @rustikcakestudio, @la_parmigiana, @lahaciendamexicangrill11968, @homesteadwindows, Stone Castle, @talobuilders, and @thecorcorangroup.

A big thank you Carrie Brudner of Black Mountain Capital for putting together this fabulous event! [link in bio]](https://hamptonsrealestateshowcase.com/wp-content/uploads/sb-instagram-feed-images/437081213_762912965932136_6847332836522786568_nfull.jpg)

![Blooms Galore at the Long Island Tulip Festival! 🌷✨ Mark your calendars for April 15th as the vibrant tulips at @waterdrinkerlongisland burst into full bloom! Enjoy a day filled with colorful splendor, food trucks, live music, and more. [link in bio]](https://hamptonsrealestateshowcase.com/wp-content/uploads/sb-instagram-feed-images/437083429_974242677583725_6855805712693638343_nfull.jpg)