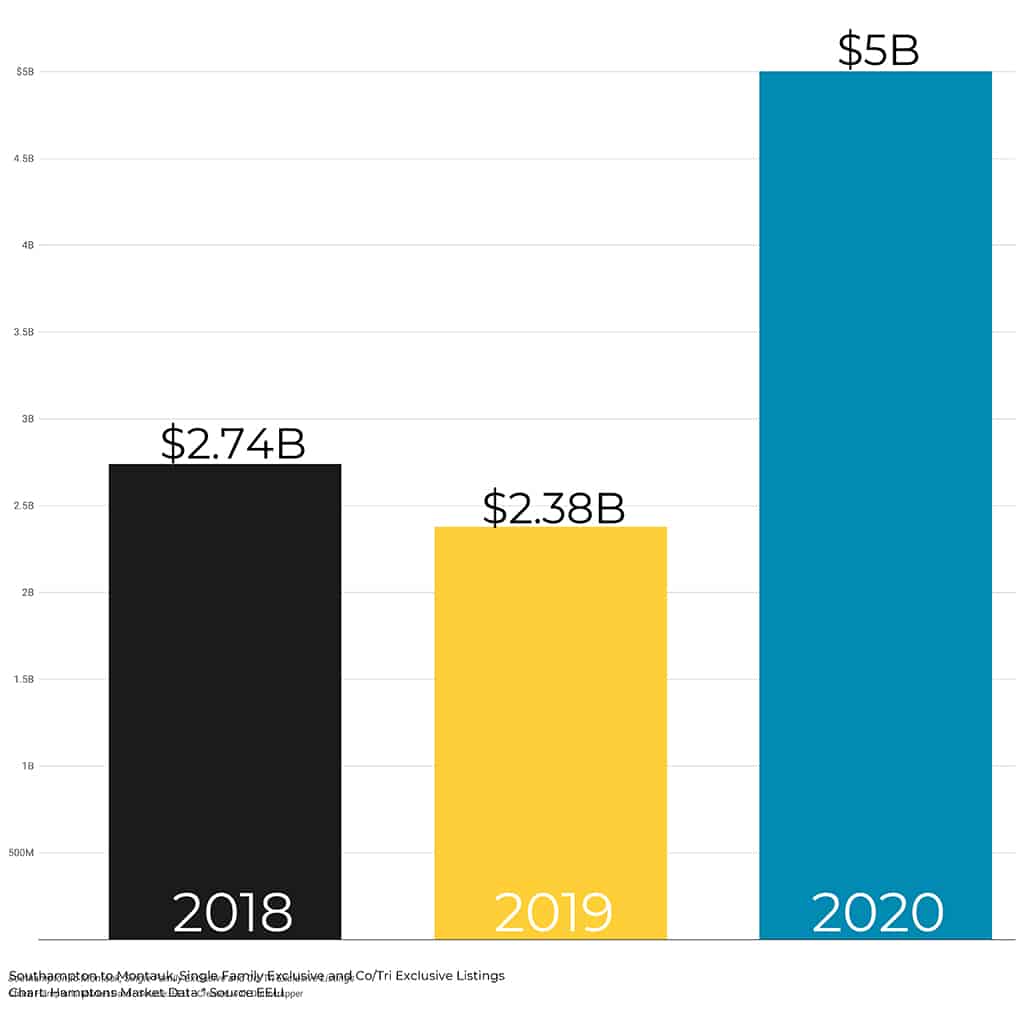

SALES IN THE HAMPTONS UP 80% YEAR OVER YEAR…MEDIAN PRICES RISE 24%

By now we all know what a banner year 2020 was for real estate on the South Fork. For those who may have missed it, 2020 registered almost twice as much volume of property transacted as 2019 and 2018 combined. Sales were up 80% year over year. Several areas like Wainscott, which registered a 124% sales increase, performed exceptionally well.

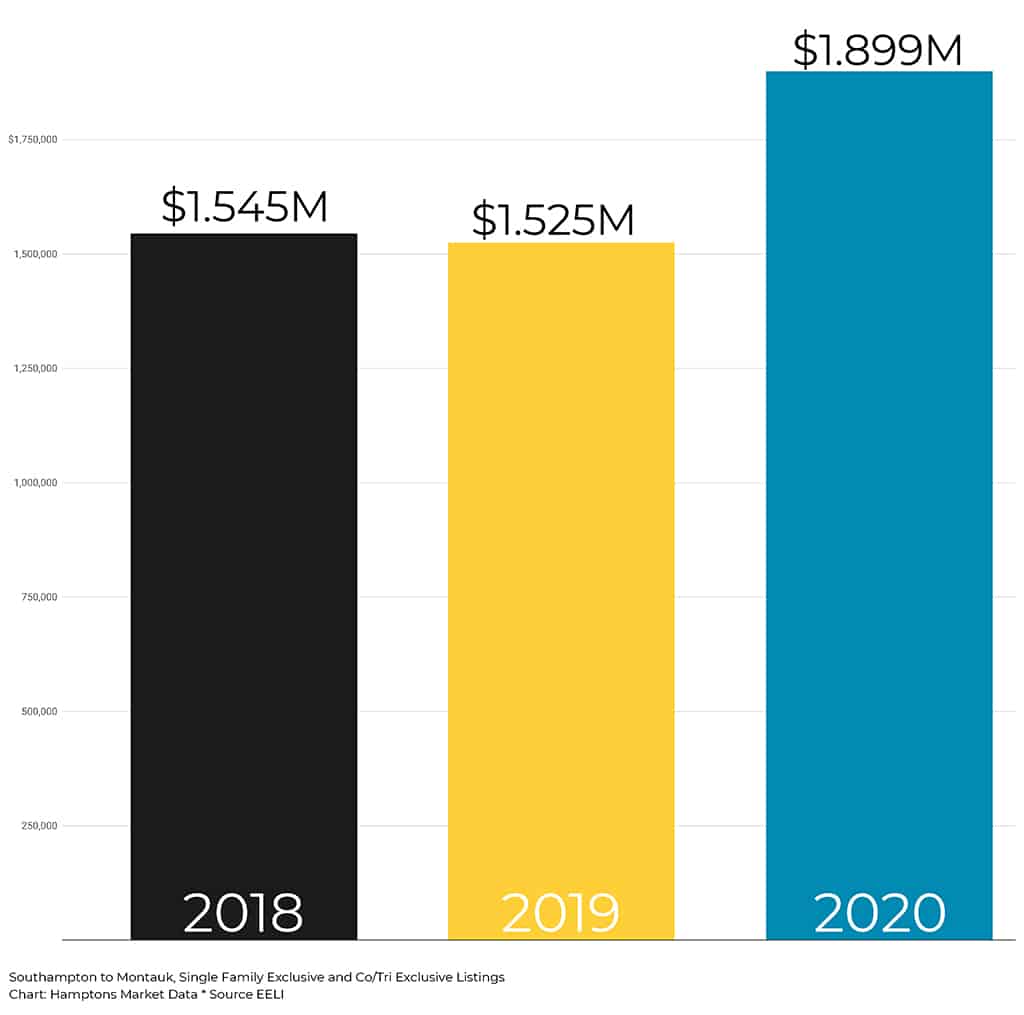

The value of homes also increased overall. The South Fork’s median sales price increased 24% year over year, up from $1,525,000 to $1,899,000.

The best way to illustrate the increase in value is by price point barrier breakthroughs. Fifty-five percent of homes that closed between $5M and $5.2M were listed below $5M. The market fortified itself. For example, 122 Miankoma Lane in Amagansett was listed at $2,995,000 on September 17th, 2020 and closed on October 19th for $3,005,005. This encouraged its neighbor, 77 Miankoma Lane, to list for $3,275,000 on October 23rd, and ultimately close for $3,351,000, a mere 46 days from its original list date. Both properties would have likely sold for less than $3M in 2019. The Shifman Flaherty Team of Compass represented both properties. “Some of the same buyers who did not win the bid for 122 came to view and also bid on 77 Miankoma Lane. There were also multiple new buyers with offers as well. Some of these buyers are still circling and hoping to find something in the Amagansett Lanes for 2021,” said Kevin Flaherty.

Clearwater Beach in Springs, a historically affordable South Fork neighborhood, with community only beach access and marina, where even waterfront property on Gardiner’s Bay hasn’t traded above $2.9M in recent years, may have just been the most popular neighborhood on the South Fork in 2020. More sellers here got their asking prices or more than anywhere else. Since the pandemic, 55% of properties here have traded at or above their list prices, increasing to 61% in Q4 of 2020. Overall, the less than $1.5M price point performed the best in 2020 with listings in this range having 76% odds of selling. This was followed by the $1.5-2.999M price point where listings had 59% odds of selling. According to the National Association of Realtors, even the hottest markets rarely see 50% odds of selling.

The odds of selling for homes priced $10M and above were an impressive 43%, but 95.77% transacted at a discount, with 47% accepting 10% or more off of their list prices. Only two properties in this price point traded for more than the asking price. 113 Mid Ocean Avenue in Bridgehampton, represented by Susan Breitenbach of The Corcoran Group, sold 0.25% above the $19,995,000 list price, just enough for the buyer to secure the listing at an even $20M. According to Breitenbach, “113 Mid Ocean was priced fairly and was also an exceptional oceanfront property, which spurred a bidding war.” The second over list price trade was 232 First Neck Lane in Southampton, represented by Harald Grant of Sotheby’s International Realty. It closed for $15,950,000, 6% over the $14,995,000 list price. Breitenbach continued, “in this market there have been a lot of bidding wars, which we haven’t seen in years, not all of course ending up over asking price.” This is true for the market at large; most bidding bars did not result in an over-asking price deal.

113 Mid Ocean Avenue, Bridgehampton

Susan Breitenbach, Corcoran

232 First Neck Lane, Southampton

Harald Grant & Bruce Grant

The $5-9.999M price point similarly struggled to achieve seller asking prices. Listings in this price range had 47% odds of selling, but 84% of sold listings traded for a discount. “That’s the one good thing in this market. With so many buyers ready to move, you know when a listing is overpriced,” explained Diane Shifman of Compass who, along with her business partner Kevin Flaherty, represented the Miankoma Lane properties previously referenced. The data show that, in the current market climate, as a general rule of thumb, if a listing has been on the market for 174 days or more, it is stale. Before 2020, this was around 264 days. Shifman continued, “Buyers out there shouldn’t be afraid to make an offer on something that’s been sitting for a while. It helps us confirm pricing with sellers and they may be the ones to get a deal on a property they love.”

Miankoma Lane, Amagansett

Kevin Flaherty & Diane Shifman, Compass

As a second home market, overpricing has always been a trend on the South Fork and it isn’t limited to our highest price points. For example, one property in East Hampton came to the market at $695,000 in October 2020, took a couple price reductions along the way before finally reducing to $599,000 in late January. A good move considering that by the end of January, 60% of available South Fork supply priced below $1M had already gone into contract. Sara Goldfarb of Douglas Elliman Real Estate elaborates, “Because of the velocity of trades happening, prospective purchasers can look at the data and compare pound for pound what they feel they should be paying for a property — they then base their bids off of these known factors because 99% of the time there will have been a comparable sale in the last 2-4 months.”

Pricing can be a challenge on the South Fork. Historically speaking, the typical low volume of trades usually leaves agents and sellers taking a best guess at what the asking price today should be. Many sellers are also in a position that leaves them comfortable testing the market, which results in a high percentage of overpriced listings. In 2020, despite the clear increase in overall value of the market and widespread bidding wars, 76% of properties that transacted on the South Fork went for a discount. In fact, almost 20% of total sold listings traded for 10% or more off the list prices. One property that had originally been listed in 2018, went on and off the market several times, finally saw it’s day in 2020, but for 74% less than its original asking price.

24 Parrish Pond, Southampton

Angela Boyer-Stump, Sotheby’s

Properties that come to the market well positioned in most areas and price points today will see immediate activity. “Recently, while showing properties, I waited in my car with buyers behind me in their car at a new listing that had multiple buyers waiting in a line to access a newly listed home. It didn’t quite work for my buyers, but it did sell quickly. The Covid restrictions and the hot market have certainly changed how to look at homes!” reports Angela Boyer-Stump of Sotheby’s International Realty.

Data shows that the best strategy in today’s market for a stale or overpriced listing to gain the best possible price is either a price reduction marginally below market value to drive interest and encourage multiple bids, or to go off the market for a period of at least 30 days and then re-list at a more realistic market price. While not common, since the fall of 2020, we have seen some stale listings that utilized this strategy attract offers and close over the re-list price.

Going into 2021, the demand for South Fork properties has stayed strong while new listings to market took a steep and rapid decline after September 2020, and remain low compared to buyer demand in most parts of the market. The absorption rate on the South Fork has been impacted by the large number of overpriced stale listings. January 2021 showed a 13% absorption rate (less than 15% indicates a buyer’s market while 20% or more signals a seller’s market), but absorption surges to 25% when removing stale listings from the inventory supply. The odds of selling in January 2021 for the South Fork as a whole was a perfect 100%.

Adrianna Nava is the Founder & President of HamptonsMarketData.com. She is a real estate investment strategist specializing in the Hamptons market.

!['The Maples' is a prestigious generational compound of two extraordinary estates: 18 Maple and 22 Maple. This rare offering, designed by luxury architect Lissoni partners New York and developed by visionaries Alessandro Zampedri-CFF Real Estate and JK Living, redefines opulence with the highest quality of craftsmanship and captivating views of the Atlantic Ocean. Represented by @nycsilversurfer and @challahbackgirl of @douglaselliman. [link in bio]](https://hamptonsrealestateshowcase.com/wp-content/uploads/sb-instagram-feed-images/438891010_1083749139481747_7890082604579275354_nfull.jpg)

![Featuring 360-degree water views on Mecox Bay, the Atlantic Ocean and Channel Pond, 1025 Flying Point offers the ultimate beach cottage that is flooded with natural light. With panoramic views, proximity to the ocean, and a private walkway to Mecox bay for kayaking or paddle boarding, this truly is a special retreat. Represented by @ritcheyhowe.realestate and @hollyhodderhamptons of @sothebysrealty. [link in bio]](https://hamptonsrealestateshowcase.com/wp-content/uploads/sb-instagram-feed-images/438994305_737511778456166_4602476013493875279_nfull.jpg)

![Attention advertisers! 📣 Secure your spot in the highly anticipated Memorial Day edition #HRES. Reach thousands of potential clients and showcase your brand in one of the most sought-after publications in the Hamptons, NYC, Palm Beach, and beyond. Contact us now to reserve your ad space! [link in bio]](https://hamptonsrealestateshowcase.com/wp-content/uploads/sb-instagram-feed-images/438549843_275102939023235_6718257301437562124_nfull.jpg)

![You eat with your eyes, and on the East End, it’s important that what you eat looks just as good as how it tastes. At @rosies.amagansett, the restaurant itself is plenty photo-worthy with blue ceramic tiling and yellow and white striped fabric wallpaper. But for a dish that will light up your photos, head directly to the salmon tartare! [link in bio]](https://hamptonsrealestateshowcase.com/wp-content/uploads/sb-instagram-feed-images/437094269_7296727147115953_1594410326824303644_nfull.jpg)

![We were honored to be the media sponsor for @blackmountaincapital's open house event with @jameskpeyton and @jfrangeskos at 11 Dering Lane in East Hampton! Other sponsors included @landrover, Feline Vodka, @rustikcakestudio, @la_parmigiana, @lahaciendamexicangrill11968, @homesteadwindows, Stone Castle, @talobuilders, and @thecorcorangroup.

A big thank you Carrie Brudner of Black Mountain Capital for putting together this fabulous event! [link in bio]](https://hamptonsrealestateshowcase.com/wp-content/uploads/sb-instagram-feed-images/437081213_762912965932136_6847332836522786568_nfull.jpg)

![Blooms Galore at the Long Island Tulip Festival! 🌷✨ Mark your calendars for April 15th as the vibrant tulips at @waterdrinkerlongisland burst into full bloom! Enjoy a day filled with colorful splendor, food trucks, live music, and more. [link in bio]](https://hamptonsrealestateshowcase.com/wp-content/uploads/sb-instagram-feed-images/437083429_974242677583725_6855805712693638343_nfull.jpg)