Market volatility abounds across much of the US real estate scene, as the tech sector and other labor markets continue to shed employees resulting in the contraction in the corresponding real estate markets. According to Parcl Labs, a real estate data firm, every state between Texas and California is seeing negative year-over-year housing prices – the hardest hit areas being San Jose and San Francisco. Not so for South Florida, which continues to see a surge in domestic and international wealth migration. Homebuyers from high-tax, high-density states are continuing to relocate and purchase prime properties at price tags of $1 million and up. Some of the top South Florida brokers share their perspectives on the unique aspects of South Florida real estate…

What’s in store for the 2023 market?

Margit Brandt, Senior Luxury Real Estate Advisor at Premier Estate Properties in Palm Beach leads off. “It’s hard to speak for every South Florida market, because the supply dynamics are different in Miami, Broward, and Palm Beach counties. But here in Palm Beach, we’re forecasting pricing stability in the overall $5M+ market in the near term, with continued long-term appreciation. Particularly in the coastal West Palm Beach market and North Palm Beach luxury markets, stability and sustainability are the keywords for now with appreciation on the horizon as a large number of big financial institutions plan 2024-2025 relocations to the area once office space is ready.”

Continuing her analysis, Mrs. Brandt makes some additional comments specifically reflecting the impact of the current South Florida market on Palm Beach Island and the ultra-high net worth (‘UHNW”): “For Palm Beach Island, it’s possible we will see more immediate appreciation on sales prices even if activity and volume are way down. The strength of the South Florida market has, in general, been on full display over the past year as we’ve battled significant economic headwinds without prices coming down in a noticeable way.”

Nicole Oge, Co-Founder and Chief Growth Officer of Official Partners in Miami, confirms this analysis. “The market remains strong and we have continued to see record sales in the start of 2023. Numerous big deals have taken place throughout our city in various sub-markets. We are going to close on a record breaking deal at the Oceana building in May. The biggest indicator for us is inventory. Good product is still very scarce, and that is what is continuing to command the highest prices.”

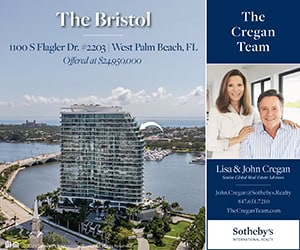

John Cregan, Senior Real Estate Advisor of Sotheby’s in Palm Beach, gets more granular. “Prices have remained anchored around Spring 2022 levels although time on market has stretched longer. The most important underpinning of our market continues to be net-migration into Florida from other states, and even other countries. That’s true for all of Florida, but especially true of the Palm Beach area where the buyer demographic tends to be both wealthy retirees and younger, high-income professionals. Those buyers generally have greater flexibility and financial resources – so, at the margin, are less affected by higher mortgage rates, the need to sell another home and other factors.”

Mr. Cregan continues: “As to leading indicators, we have seen our inventory of homes for sale rise over the last nine months though the number of listings is still well below average. Pre-Covid the number of Single Family, Condo and Townhouse Listings for the island of Palm Beach fluctuated in the 600-650 range. In the first quarter of 2023, there was an average of 314 homes for sale in Palm Beach according to the Palm Beach Board of Realtors.

Corcoran’s Jennifer Kilpatrick shares her insight. “South Florida prices are remaining strong but we are definitely seeing stabilization in the market over the frenzy of the last few years. We are still seeing limited inventory — especially in newer luxury construction — that is driving the high demand in the Florida Market due to the steady influx of new Floridians. Post-pandemic, we have experienced last year’s frenzy and now are definitely seeing more opportunities for buyers but the market remains strong in South Florida.”

At what price point are you seeing the most action in terms of offers/sales? In what neighborhoods/zip codes?

Cregan: “The $1M-$5M condo market is red hot for good units in good buildings. And super high-end Palm Beach waterfront properties are selling quickly as well. What passes for our “middle-market”, the $8-18M single family home in Palm Beach and the $3-5M home in West Palm, has been a little quieter.”

Kilpatrick: “Homes under $2.5 and over $6M are still moving well but says on market have increased. East Boca and East Delray are still in demand.”

Oge: “Miami Beach turnkey homes $20M+ on the water – it’s still the area of the market in most demand.”

Brandt: “Palm Beach Island has definitely seen the most action, with coastal West Palm Beach (South of Southern or “SoSo”) being a strong runner-up. Also in the mix is the five-star gated communities in Northern Palm Beach County — Seminole, Lost Tree, Old Palm, Old Marsh, Bear’s Club, Admiral’s Cove, Trump Jupiter — there is big demand to be in secured locations near great entertainment and top-notch schools like Benjamin. I would say the $5M-$15M market has been the most difficult, and the $20M+ market, which is traditionally “cash” buyers, has performed much better. But even in the $5M-$15M arena, there haven’t been big drops in pricing, it is just more inventory on the market and more days on market. The inherent values are holding up or going up.”

What impact do you see financial market volatility and interest rate increases having on the market?

Margit Brandt jumps right in with a very detailed explanation. “The volatility in the financial markets brought us to more of a flat, consistent market versus one that was on target to continue growing quite rapidly once again. It’s basically been a wash between the tailwinds and the headwinds. On one hand, you’ve got these economic question marks, but on the other hand you have continued demand and desirability. Our phones are still ringing off the hook with people wanting to move here and we’re still showing houses all day, but buyers are taking more time to make decisions and also having more difficulty getting their heads around the capital requirements.

Mr. Cregan analyzes the issue from a different perspective. “We saw some trepidation from buyers during the Silicon Valley/First Republic bank scares. But with the Fed and Treasury seeming to have ring-fenced those problems, that nervousness has receded. The reflexive response on mortgages is that Palm Beach buyers don’t take mortgages. While it’s true that Palm Beach is definitely a “cash offer” market, even our wealthiest clients often took a little borrowed money when rates were ultra-low, so higher rates are not a zero impact on our market.”

“Financial market volatility is definitely playing a part as we are seeing buyers taking their time to mull their options and make offers,” explains Ms. Kilpatrick. “We expect for the South Florida real estate market to soften over the summer and then for it to rebound when season ramps up in the fall, returning to a more traditional market flow, based on seasonal patterns.”

And Nicole Oge sums it all up in one sentence: “Buyers have had some hesitation to pull the trigger in the past couple of weeks, but I expect that to disspitate. The reality is we still have more buyers than product to sell them.”

What about lifestyle? Are buyers still coming to South Florida for a serious lifestyle change or are we back to a “snowbird” market?

We will always have our snowbirds looking for Pied-e-terres, that will never change,” shares Nicole Oge. “What the pandemic caused was encouraging more young families to consider South Florida as their home base. We still get a ton of calls from buyers looking to move down here, but the lack of supply is what has slowed down the process.”

“If you’re calling a homeowner who lives here 6-9 months a year a ‘snowbird’, then no, that has not changed,” explains John Cregan. “The affluent older crowd has a rhythm to their seasons that wobbled only slightly during Covid. All that really changed was that even more of their friends moved down to join them. For younger families that got a taste of the lifestyle here during Covid – the weather, the community, (the untaxed income) – there was no going back. In addition to listings generated by the normal demographic churn, the properties that developers bought on spec in 2021-22 and renovated are just now coming to market. So there’s more to choose from, but a nice home on a good block if well-priced, still sells quickly.”

Margit Brandt sums it all up. “We’ve seen a shift over the past decade from 3-4 month residency traditionally, then a transition to 6 month residency for tax purposes (which started in 2017 with the tax cuts), and now we are at about an 8-10 month residency schedule…Some of our clients will leave June-August or June-September/October, but very few will leave for more than 3-4 months. That speaks to the full-time nature of our community, with clients joining social clubs, opening offices, and enrolling their kids in school. This isn’t just a resort anymore — it’s home.

And Jennifer Kilpatrick agrees. “Buyers are coming to Florida to take advantage of the spectacular year-round weather and more amenable tax breaks. We are seeing more people locating here as year-round residents and many of them are young families and younger residents. A few who initially came during the pandemic have returned to NYC and other locales in the north. But most are here to stay as full-time residents and there are still many that are here as seasonal snowbirds. South Florida remains a hot spot for people moving to the state. It offers a lifestyle beyond compare.”

![At @inspirseniorliving, they’re transforming senior living and elevating every dimension of life. With a philosophy that embraces enhanced wellness and immersive experiences, their communities offer residents a lifestyle that meets and exceeds everything they’ve envisioned for their lives; including Assisted Living, Memory Care, or Enhanced Care. [link in bio]](https://hamptonsrealestateshowcase.com/wp-content/uploads/sb-instagram-feed-images/452692090_1818077558601184_7837181803899896025_nfull.jpg)

![A winding private drive leads the way to 198 Two Holes of Water Road, situated on 10± acres with plenty of seclusion, privacy, and an all weather tennis court. After undergoing a top-to-bottom renovation in 2019, the estate has been marked by dramatic sculptural touches, wide expanses of scenic space, and is ready for immediate occupancy. Represented by @tomcavallo of @douglaselliman. [link in bio]](https://hamptonsrealestateshowcase.com/wp-content/uploads/sb-instagram-feed-images/452714375_18452144299030135_7245639606158274147_nfull.jpg)

![When Brooke Abrams undertook the interior decoration of an ultra-modern beach house designed by Bates Masi + Architects, her clients wanted everything to look very "rich and luxurious." In addition to unifying the interior space with the exterior space, Abrams sought to bring a sense of cohesiveness to the house. “It had a lot of beautiful pale woodwork in creams and beiges and greys,” she recalls. “Rather than introduce new colors, I felt it was important to stay within that neutral palate so that everything felt integrated.” [link in bio]](https://hamptonsrealestateshowcase.com/wp-content/uploads/sb-instagram-feed-images/452279191_374759435318292_2948881216648686178_nfull.jpg)