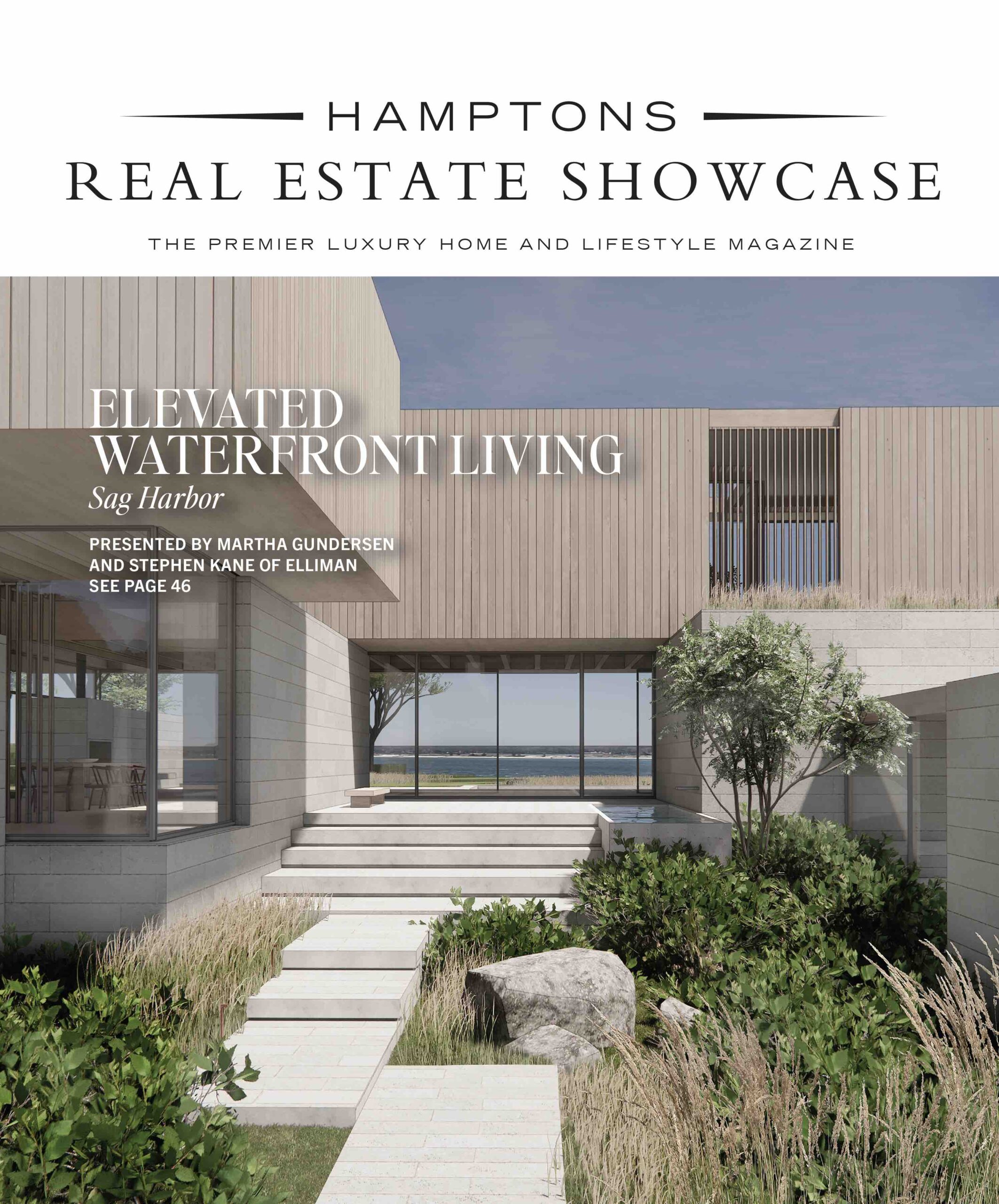

The Hamptons. Just the words conjure images of beautiful people living in beautiful houses on beautiful beaches. Southampton beachfront properties, in particular, hold a unique charm, with a tree-lined Main Street at the center of a quaint but seriously fashionable village filled with restaurants, clothing boutiques and no shortage of shops with candles, cashmere throws and local artwork. Galleries, exclusive golf clubs and breathtaking homes, and oh, yeah, those amazing beaches complete the undeniable draw of Southampton.

Whether it’s one if the area’s incredible beaches, scenic ponds, or even just a nice swimming pool, having water nearby puts the “vacation” in “vacation house.”

If you have dreamed of someday living on the beach in Southampton, you are not alone. Transforming that dream into reality requires the same skills as buying any other home — along with some specialized knowledge. If you invest the time, and you have patience and finances to spare, you can definitely make that dream happen.

What it will cost

The average price for a home in the Hamptons is 2.4 million. If an oceanfront home is what you desire, expect to see properties around a median price of $6.4 million — $4 million, (or 190 percent) more than the median cost of a house not on the water. According to curbed.com, water views and access can be a bit more affordable if you decide to go for something with bay, pond, or creek frontage rather than something on the Atlantic.

Knowing the market

Whatever their size, homes on the ocean are difficult to come by: according to Out East, just 4 percent of all for-sale homes in the Hamptons are directly on the ocean. Oceanfront homes with a pool are even more rare, at 3.5 percent of all for-sale inventory.

Sales of homes in the Hamptons fell 6.6% in the first three months of 2018 as some buyers paused to digest all the implications of the 600-page tax bill that was hastily passed by Congress at the end of 2017 and went into effect Jan. 1.

Consider renting

Mary Ann Cinelli, real estate agent with Brown Harris Stevens of the Hamptons says that one good way you can test the waters (or the home on the water dream) is to find out before you buy: Rent. See what you really like. Some summer dwellers who sail prefer the bay side of the Hamptons — located on Long Island in New York — while those who enjoy shelling want to be on the ocean, she says. Family beaches often have lifeguards in the summer while other stretches are more secluded. And dog owners may prefer being on or near one of the many dog beaches.

A great agent

When you are serious about starting your hunt, make sure you find the right agent—someone who truly knows the market, who you like and trust. According to Mary Slattery of Corcoran, the biggest mistake a buyer makes is not working with a real estate professional to guide them in this process. “The Internet has given buyers the false sense of knowing our market. Real estate brokers are involved day-in and day-out in buying and selling. We really are more knowledgeable than any real estate website.”

Take the time to view as many properties as you can to make sure the decision is right for you. Ownership is a year-round proposition, so look at the community in the off-season, too.

It’s amazing how popular you become once you acquire a beach house.

So take a good look at how many bedrooms and bathrooms you’ll need, just as you would with a primary home. Will you be doing some entertaining, especially in the summer?

Finances

If you are financing part of this purchase, and plan to use the house as a second home or vacation home rather than your primary residence, you’ll need a solid credit rating — and enough cash flow to comfortably make 2 mortgages, along with a nice cash cushion.

Rates are roughly 1 percentage point higher than this time one year ago—but historically low in comparison to the double-digit highs of the 1980s. The Federal Reserve raised its benchmark interest rate a quarter-point to 2.25 percent in September—its third hike in 2018.

The new federal tax regulations limit some longstanding tax benefits of owning a second home. Changes include capping the mortgage interest deduction at $750,000 and reducing the deductibility of property taxes.

Potential rental income

Dana Trotter, a Sotheby’s International Realty senior global real estate adviser and associate broker says, “One strategy we’ve seen to take advantage of a mortgage-interest deduction on a second home is to purchase the property with an LLC and then rent it out when not in use. By setting it up as a rental investment property, the owner can deduct the mortgage interest, collect rent to help with carrying costs, and still enjoy the property at their leisure. We would, of course, advise anyone planning to do that to work closely with their tax adviser to make sure it is done properly,” Ms. Trotter said.

Bear in mind, this income may be offset by new expenses, such as hiring someone local, perhaps a caretaker, to look in on your property from time to time. In some places where vacation rentals are common, like Southampton and East Hampton, you’ll need an inspection and license. If the sellers rented the house, ask how much the property earns every year or every summer. Ask to see written records of the rental income.

Unique coastal issues

When searching for beachfront property, you need to keep an eye out for issues that are beach specific:

- Is the home in a flood plain?

- Will you need additional insurance?

- Do coastal laws allow you to rebuild if the house is lost to the forces of Mother Nature?

Coastal properties are more vulnerable to flooding and storm damage, so you’ll likely need special insurance for flood, wind or hail damage just to get a mortgage, says Chris Hackett, senior director of personal lines for the Property Casualty Insurers Association of America. “You want to look at the cost of flood insurance before you buy the property,” he says.

One good source of flood insurance information for homeowners and potential homeowners is FloodSmart.gov.

Other factors to weigh in your search: the style of the house, how easy it will be to maintain it (especially in light of sand and salt water exposure), and the repairs or renovations the place will need.

When you’re seriously considering a particular beach house, it’s time to call in a couple of specialists. Consult with an environmental company to make sure everything is legal, and, if you plan on making renovations, make sure everything you want to change can be done. Some localities limit what you can do — or spend — on renovations. There are many variables.

“You have to do your due diligence before you sign anything,” says Andrea Ackerman, associate broker with Brown Harris Stevens. “Waterfront is very, very tricky.” She adds, “If storms are frequent or severe, you may also want to get a generator.”

Before you buy, get an inspection from a licensed home inspector who is familiar with beach properties. They can pick up on small things that could signal big trouble.

When you go in, armed with the complete picture of the market and a well-researched hunt with a trusted agent, you will undoubtedly uncover a gem. The beachfront home you wind up purchasing, and adorning with all those candles, cashmere throws and fabulous artwork, will not only be dreamy, but most likely an amazing investment that you, (and anyone you’ve ever met) will enjoy for the rest of your days.

![Experience luxury, privacy, and resort-style living at this exceptional Shelter Island compound 🌳 139 N Ferry Road is a hidden gem featuring a custom-built main house, a gunite pool, radiant heat throughout, and a 1 bedroom guest apartment, all tucked away on 1.1± secluded acres.

Saturday, July 12th | 10am-12pm

Contact @annmarieseddio of @atlassalesrealty for more details. We hope to see you there! [link in bio]](https://hamptonsrealestateshowcase.com/wp-content/uploads/sb-instagram-feed-images/517355052_18521041705030135_8404531768775791793_nfull.webp)

![When clients bring bold ideas to the table, magic can happen. In Sag Harbor, interior designer Jessica Gersten crafted a light-filled, seven-bedroom home layered with sculptural details, playful textures, and statement pieces, including a forged-iron swing and a custom light fixture that anchors the double-height stairwell. The result is a space that feels as bold as it is livable. [link in bio]](https://hamptonsrealestateshowcase.com/wp-content/uploads/sb-instagram-feed-images/516636957_18520674460030135_5909864759900962270_nfull.webp)

![Tucked along the shoreline of West Neck Harbor, this Shelter Island retreat offers a rare opportunity for relaxed waterfront living. ☀️⚓ With a waterside pool, deep water dock, guest cottage, and 220± feet of bulkhead frontage, every inch of the property is designed to embrace the outdoors. Inside, rich architectural details, sun-filled rooms, and elegant entertaining spaces blend comfort with character, making this a true summer escape.

37 East Brander Parkway, Shelter Island

Represented by Rebecca Shafer @myshelterisland of @thecorcorangroup [link in bio]](https://hamptonsrealestateshowcase.com/wp-content/uploads/sb-instagram-feed-images/515283061_18519694612030135_1293239383085970748_nfull.webp)