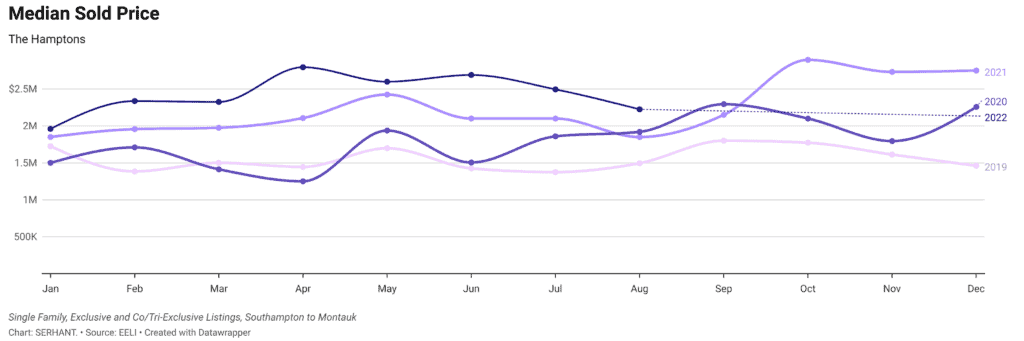

The Hamptons Market Takes a Breath with Price Adjustments Becoming more Commonplace

The million-dollar question on everyone’s mind these days about Hamptons real estate: where are we headed? Are we looking at the onset of a downturn?

“No,” reports Judi Desiderio, CEO of Town & Country Real Estate. “Where we are right now is stalled.” Ms. Desiderio continues her analysis by explaining that the Hamptons markets are returning to a normal cycle from before the Covid explosion where spring and fall are the busiest seasons, and January and July are the slowest months – with a caveat. “After a normal, slow July, August never picked up primarily because of the stock market. The real estate market in the Hamptons took a breath. And now in September, we are seeing that prices are being adjusted.”

121 Jessup Lane, Westhampton Beach

Pricing adjustments are becoming more commonplace, as buyers are no longer in the Covid mindset of purchasing at any price. “Sellers are now beginning to understand that pricing should not be based upon the expectation that the market will continue to rise,” shares Gary DePersia, a broker in the East Hampton office of Corcoran. The steep upward trajectory in pricing experienced by the Hamptons market during Covid has leveled off; however, this doesn’t mean that the market is poised to fall out of bed. “Prices are being reduced to reality pricing,” continues Mr. DePersia, “not fire sales. The properties are being reduced to and selling at price points where they should have been all along.”

2 Charlies Lane, Shelter Island

Tim Morabito from the Westhampton Beach office of Compass agrees. “If a seller is reaching a little bit too much, the property may be languishing on the market. Deals are still coming together at the right price point.” Morabito doesn’t see the bottom falling out of the market – nor does he believe that pricing will continue to increase as during the pandemic. “If you have a good product at the right price, there are so many buyers that the product will go.” Proving his point, Mr. Morabito discussed a specific data point collected and reported by Compass in respect of the 2022 market: negotiability rate. “In 2022 so far, Compass reports that the negotiability rate is less than 1%.” The negotiability rate is the strict contrast between asking price and contract price; such a low negotiability rate indicates that the only properties that get to contract are those that are appropriately priced.

3 Acorn Path, Quogue

“There’s a new plateau that’s being set post-Covid from pre-Covid,” states Krae Van Sickle, a broker with Saunders in Bridgehampton. “It’s a pretty healthy market now, more balanced. And prices are certainly not Covid prices.” And what makes this market different from the Covid market? “This post-Covid market is different because of increasing costs, inflationary pressures, rising interest rates and the general dynamics of the stock market. There are a lot of cross-currents.” Judi Desiderio also believes that the market is normalizing. “Now we’re in a balanced market: for the amount of inventory, the market is satiated.”

353 & 359 Cranberry Hole Road, Amagansett

Despite deals happening, inventory remains a problem. “It’s frustrating,” shares Micheala Keszler of Douglas Elliman in Southampton. “We are still seeing a major lack in inventory. The market is down because there’s no inventory.” Judi Desiderio sees the lack of inventory from a different perspective. “Let’s remember that the Hamptons are surrounded on three sides by water – there’s never going to be excessive inventory because there’s no additional space. Thankfully our inventory is not excessive at the moment, or the prices would tank.”

172 South Main Street,Southampton

Inventory remains a hurdle for Gary DePersia as well. “There’s still a lack of inventory. For example, there are not a lot of spec houses. Most are getting sold in construction, which has been the case for a long time – but I expect that will change as more new construction hits the market.” Tim Morabito echoes these concerns. “Inventory is pretty lateral right now, there are very few options and inventory remains very thin.”

So, as we head into 2023, what are the expectations about the Hamptons Market? Is there going to be a downturn? “Absolutely not,” declares Gary DePersia. “I’m still very bullish on the market. The great thing about the Hamptons is that you can buy something, live in it, make it your own and enjoy it. During that time, you can figure out where and how you really want to live and decide on a new house. And you know that the house you sell will be worth more than you paid for it.”

Tim Morabito sees that high end buyers are now starting to ramp up searches. “People are transitioning dollars to hard assets from the stock market.” And while he sees the market continue to flatten out, he believes that “…no one is going to lose money. And it’s just a matter of time before supply begins to ease, which would lead to a buyer’s market from a seller’s market.”

Michaela Keszler remains positive. “My hope is that we see more inventory, and with more inventory we see more trades.” And some wisdom from Krae Van Sickle: “If you find something that you love and you can afford it, don’t wait for something to change in the market because you never know.”

![Tucked along the shoreline of West Neck Harbor, this Shelter Island retreat offers a rare opportunity for relaxed waterfront living. ☀️⚓ With a waterside pool, deep water dock, guest cottage, and 220± feet of bulkhead frontage, every inch of the property is designed to embrace the outdoors. Inside, rich architectural details, sun-filled rooms, and elegant entertaining spaces blend comfort with character, making this a true summer escape.

37 East Brander Parkway, Shelter Island

Represented by Rebecca Shafer @myshelterisland of @thecorcorangroup [link in bio]](https://hamptonsrealestateshowcase.com/wp-content/uploads/sb-instagram-feed-images/515283061_18519694612030135_1293239383085970748_nfull.webp)

![A private Sag Harbor retreat with timeless elegance and space to roam 🌿 Set on 6.5± secluded acres, this beautifully designed estate offers over 8,000± square feet of refined living, with layered outdoor spaces, a 50-foot gunite pool and spa, and ever amenity needed for effortless Hamptons Living.

47 Middle Line Highway, Sag Harbor Represented by @theenzomorabito of @douglaselliman [link in bio]](https://hamptonsrealestateshowcase.com/wp-content/uploads/sb-instagram-feed-images/513860206_18518605354030135_4589361988158119558_nfull.webp)