Welcome to 2023 – and all the questions and concerns about the state of the Hamptons real estate market as we hit the halfway mark of the first quarter of the year. Some of the top brokers in the Hamptons shed some much-needed light on a few pressing questions…

Are there any indicators of a downturn in the real estate market post-pandemic?

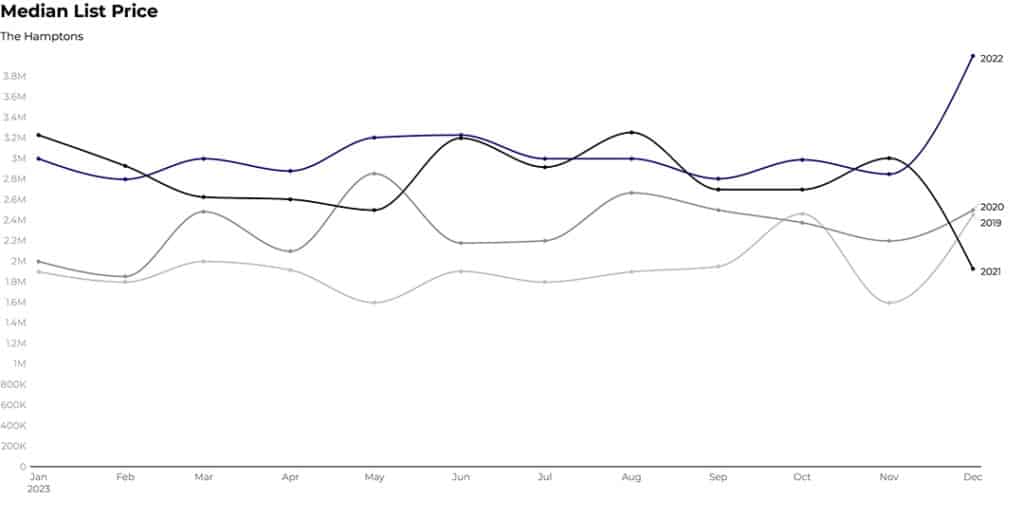

Well, it’s definitely not a downturn according to Sara Sandler Goldfarb of The Alexander Team of OFFICIAL. “Regarding a downturn, I think we should rephrase this to a market shift, which we’re already seeing,” shares Ms. Goldfarb. “Velocity has slowed to 2018-2019 levels, but, as noted, pricing still remains strong, maybe a 10-15% reduction of 2021-2022 numbers.”

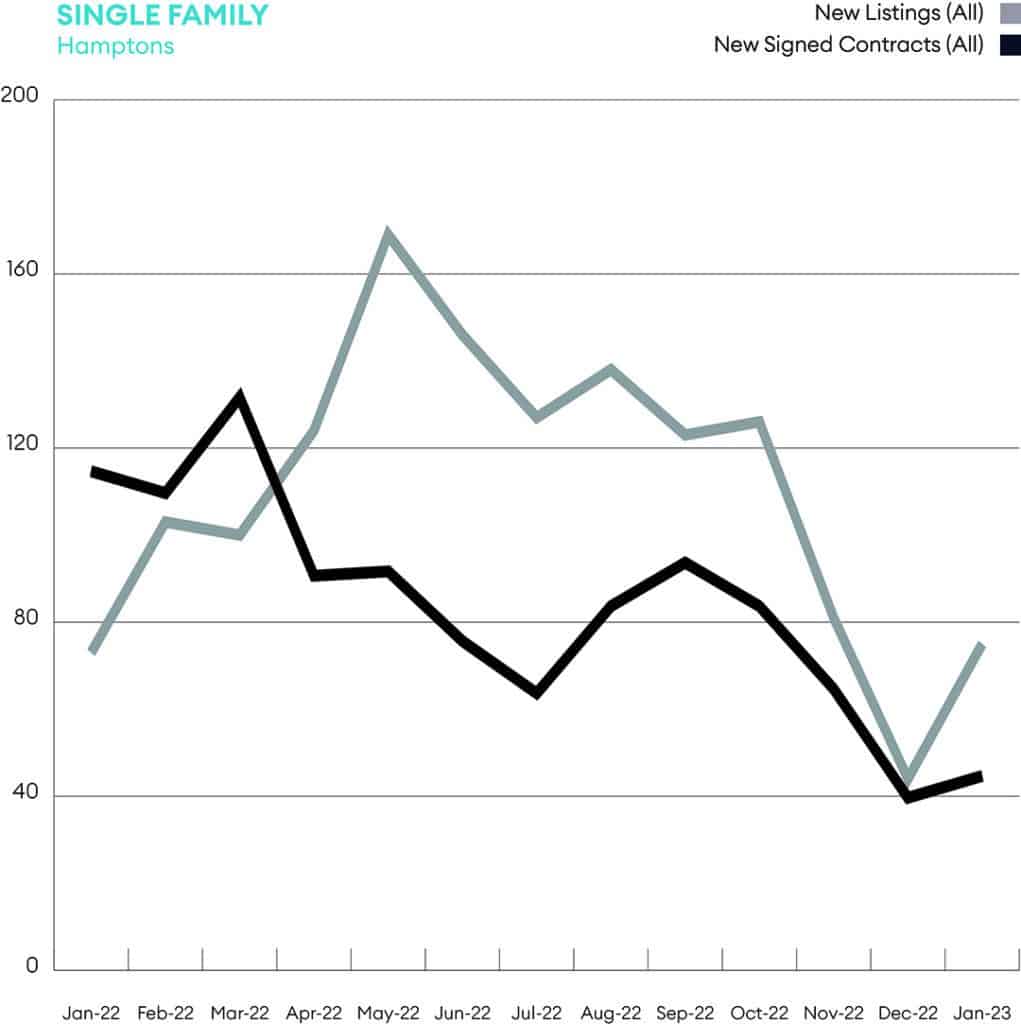

Jane Babcook, a broker with Brown Harris Stevens in Bridgehampton agrees: “I feel like we are passing the post-pandemic market. The last half of 2022 saw the slowdown we predicted and colleagues agree, but I think we are seeing pent-up buyers getting ready to pull the trigger.”

Frank Bodenchak, licensed salesperson and global real estate advisor, and member of The Bodenchak Team in the Bridgehampton office of Sotheby’s International Realty, has a little bit of a different viewpoint. “We saw a seasonal fall off in sales prices in the Fall, but prices seem to be holding in the Spring as buyers must decide whether to pay rent, in which case there is no equity value creation or purchase a home that allows for greater freedom of use and equity value creation versus lost rent.”

“This is not the pandemic,” states Kimberly Cammarata of Douglas Elliman Real Estate in Westhampton Beach. “During the pandemic, people were purchasing out of fear. Now, the buyers are shopping for value for their families – for now and for generations to come. That being said, however, we are still seeing quite a bit of change.

As other markets across the U.S. are beginning to falter, why is the Hamptons market showing strength?

Frank Bodenchak leads with the following: “Hamptons real estate was undervalued as an asset class between 2013 and pre-pandemic 2020. The massive run-up in the stock market since 2013 created a great deal of wealth, yet real estate prices lagged as there was a feeling there was always going to be new land and new constructions. That was an entirely incorrect assumption. With most land now developed, and excess inventory removed during Covid, there still is supply, and prices are remaining strong. That’s not to say that some houses on the market aren’t asking aspirational prices. Some sellers who are asking prices significantly higher than those obtained in Covid may need to lower to those levels. But clearing prices are likely down only 4%-8% from Covid highs. They are bolstered by ongoing demand and strong rental returns.”

“The last several years made people reconsider the want versus need a formula for purchasing real estate, shares Sara Goldfarb. “On some level, it’s not just about the ability to obtain yield on a piece of real estate, it’s also about being able to use, enjoy and live in it — there’s a real value in that. Naturally, real estate (especially in the Hamptons) fits this investment criterion and being the unique market that it is, will continue to have its highs and lows, so it’s a long play in this market for smart purchasers and investors.”

Are buyers coming to the Hamptons for a serious lifestyle change?

Sara Goldfarb frames her response beautifully. “When it comes to buying in the Hamptons, there will always be a lifestyle component. It’s more than just an investment — it’s a feeling that people get when they shop at Loaves and Fishes or spend afternoons on Sagg Main Beach. While every purchaser has different needs, there’s generally been a theme of three types of buyers in the current market: those that want to have a getaway throughout the year and typically have a place in the city or just outside the city, generally these tend to be first-time homebuyers. The second category is those who no longer live in New York — typically now Florida residents — and want a summer home. The third category is what we know as the traditional purchaser, a New Yorker wanting their summer home. Notwithstanding, there’s still a big contingency of year-round owners in the Hamptons post-Covid, and most businesses are still open in these ‘off-season’ months.”

Frank Bodenchak is in full agreement. “People are clearly using their Hamptons homes more during the summer and more year-round. Many of our clients are taking advantage of the superb school systems, rather than paying $50,000 (or more) per year for a private school in the city. Other clients are taking advantage of the ability to work part-time and live in the Hamptons. They have made a lifestyle with extended weekends in the Hamptons and more full week breaks in lieu of the traditional August-only vacation.”

“New Yorkers are back in the office but many are not on the five day a week wagon,” shares Jane Babcook. “These owners are still using their homes; however, those with children are back to their New York City routine.”

Kimberly Cammarata comes to the lifestyle issue from a different direction and perspective: amenities. “People want a luxury mini resort in their backyards. Buyers are looking for properties that are amenity-rich, meaning movie theaters, gyms, butler pantries, outdoor kitchens and showers, fire pits, hot tubs, golf simulators, and wine cellars – just to name a few!”

What are the hot neighborhoods?

“Southampton Village is arguably the strongest market at the current time,” according to Bodenchak. “Waterfronts and properties close to the ocean are getting the most action in terms of offers and sales” Alternatively, Goldfarb sees Sag Harbor and East Hampton Village as the hot tickets, especially in the $1MM to $3MM range, while Babcook includes Water Mill, Bridgehampton and Sagaponack on her list of zip code hot spots.

So what can we expect in 2023?

Jane Babcook predicts a return to a more normal, pre-pandemic type of market. “I see us getting back to some sense of normalcy in the market, and as March comes around those that have been sitting on the fence may decide it’s time to get in for summer.” Kimberly Cammarata echoes this sentiment. “2023 is going to be a solid year with solid transactions – steady and successful. However, it won’t be like the pandemic: it’s going to be back to work for the real estate agents with showings, advertising and marketing.”

![Tucked along the shoreline of West Neck Harbor, this Shelter Island retreat offers a rare opportunity for relaxed waterfront living. ☀️⚓ With a waterside pool, deep water dock, guest cottage, and 220± feet of bulkhead frontage, every inch of the property is designed to embrace the outdoors. Inside, rich architectural details, sun-filled rooms, and elegant entertaining spaces blend comfort with character, making this a true summer escape.

37 East Brander Parkway, Shelter Island

Represented by Rebecca Shafer @myshelterisland of @thecorcorangroup [link in bio]](https://hamptonsrealestateshowcase.com/wp-content/uploads/sb-instagram-feed-images/515283061_18519694612030135_1293239383085970748_nfull.webp)

![A private Sag Harbor retreat with timeless elegance and space to roam 🌿 Set on 6.5± secluded acres, this beautifully designed estate offers over 8,000± square feet of refined living, with layered outdoor spaces, a 50-foot gunite pool and spa, and ever amenity needed for effortless Hamptons Living.

47 Middle Line Highway, Sag Harbor Represented by @theenzomorabito of @douglaselliman [link in bio]](https://hamptonsrealestateshowcase.com/wp-content/uploads/sb-instagram-feed-images/513860206_18518605354030135_4589361988158119558_nfull.webp)